Social media analytics

What Is Competitive Benchmarking? A 101 Guide for Beginners

Learn the essentials of competitive benchmarking and how it can help you improve your business performance by measuring key metrics against top competitors

September 25, 2024

Looking to launch effective marketing campaigns and win more customers?

Start with competitive benchmarking.

It helps businesses like yours measure performance against industry rivals. With this approach, you can spot growth opportunities and set realistic objectives.

In this guide, we share the essentials of competitive benchmarking and how we implement it at Talkwalker.

You’ll learn which metrics to measure, which tools to use, and how to set up your workflows.

What is competitive benchmarking?

Competitive benchmarking measures your company's performance against that of your top competitors.

It analyzes specific metrics and generates data to shape your business objectives and strategy.

For example, you could compare:

Market share

Customer satisfaction scores

Website traffic and engagement rates

Social media following and engagement

This approach helps you assess your competitive edge and find areas for improvement.

Competitive benchmarking vs competitive analysis

Before diving into details, let’s explore the differences between competitive benchmarking and analysis.

While often confused, these approaches serve different purposes:

Competitive benchmarking

Competitive analysis

Focuses on highly specific, measurable metrics (e.g., market share)

Provides a broader view of competitors' strategies and market positioning

Aims to improve particular aspects of business performance

Helps understand the overall competitive landscape

Works as an ongoing process with regular updates

Usually conducted periodically (e.g., when launching a new product)

Generates actionable data for setting performance targets

Informs overall business strategy and decision-making

In other words, competitive benchmarking measures specific performance metrics. And competitive analysis provides a broader assessment of your competitors' strategies.

Used together, they offer the detailed insights and strategic context you need to outperform your rivals.

Why do you need competitive benchmarking?

Do you really need to spend time and effort on competitive benchmarking?

Absolutely.

It’s essential for understanding the competitive landscape in your niche and building effective business strategies.

Here are the main benefits of benchmarking against your rivals:

It lets you pinpoint areas where your business lags behind competitors and prioritize elements that need improvement

It helps you establish objective and achievable performance metrics

It makes your decisions and marketing plans more data-driven and effective

It reveals best practices, encourages innovation, and pinpoints bottlenecks in your strategy

It allows you to understand what resonates with your target audience and what they expect from the top performers in your niche

The top competitive benchmarking metrics you can track

Social media followers and engagement

Social media follower count represents the number of users who have subscribed to your social media profiles.

And social media engagement measures the interactions your content receives from various users. It includes likes, comments, shares, and clicks.

💡Higher engagement rates and follower counts compared to your competitors indicate stronger contention to your audience and brand loyalty.

For example, you can check metrics like the followers count by manually examining each social profile:

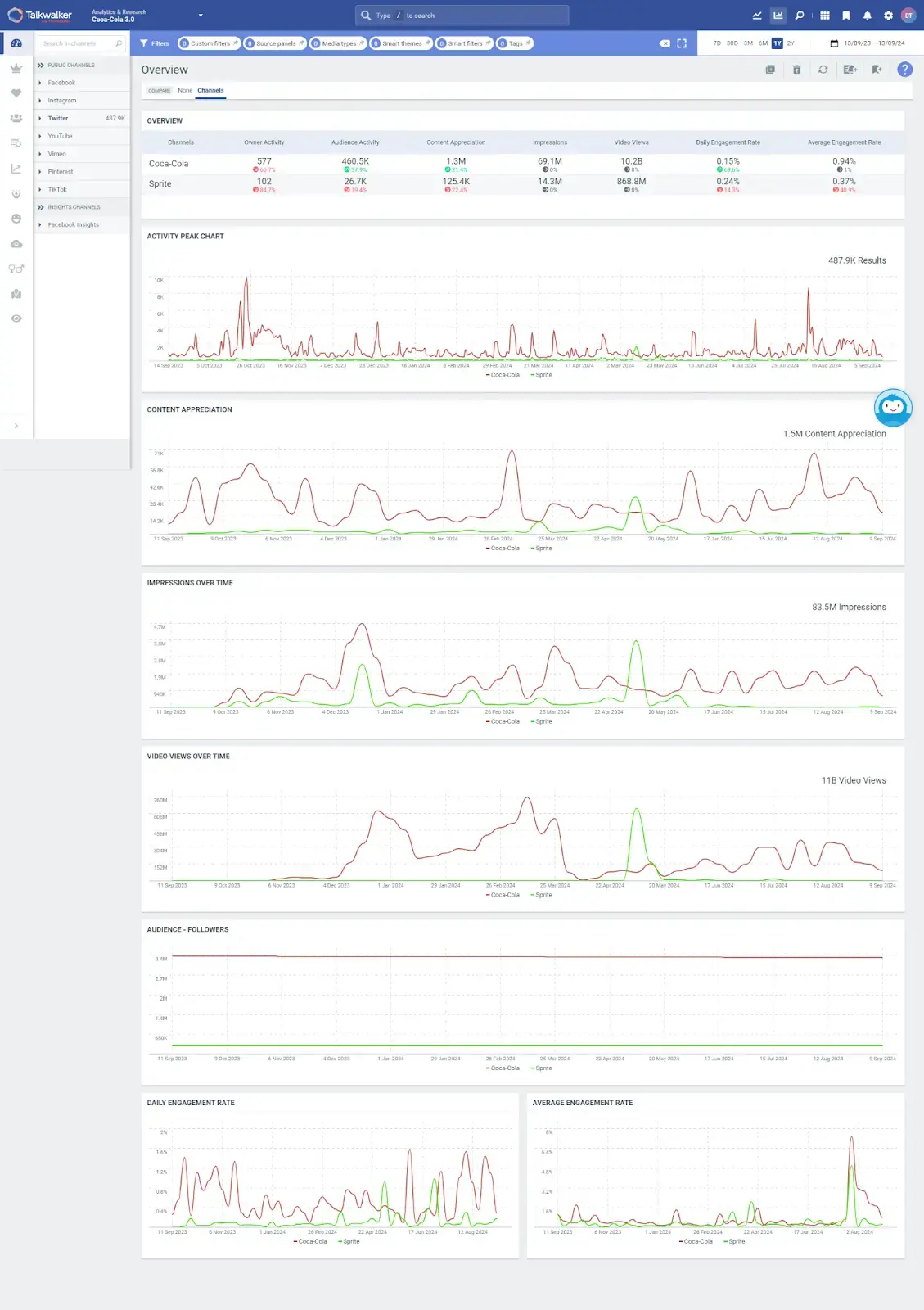

Tools like Talkwalker’s Social Benchmarking also help you do this at scale and gain deeper insights.

For instance, you can use it to benchmark your overall social performance against competitors and industry standards.

{{cta('92303005422')}}

We have tested and compared the best competitor analysis tools for your 2025 tech stack.

Rankings and SEO performance

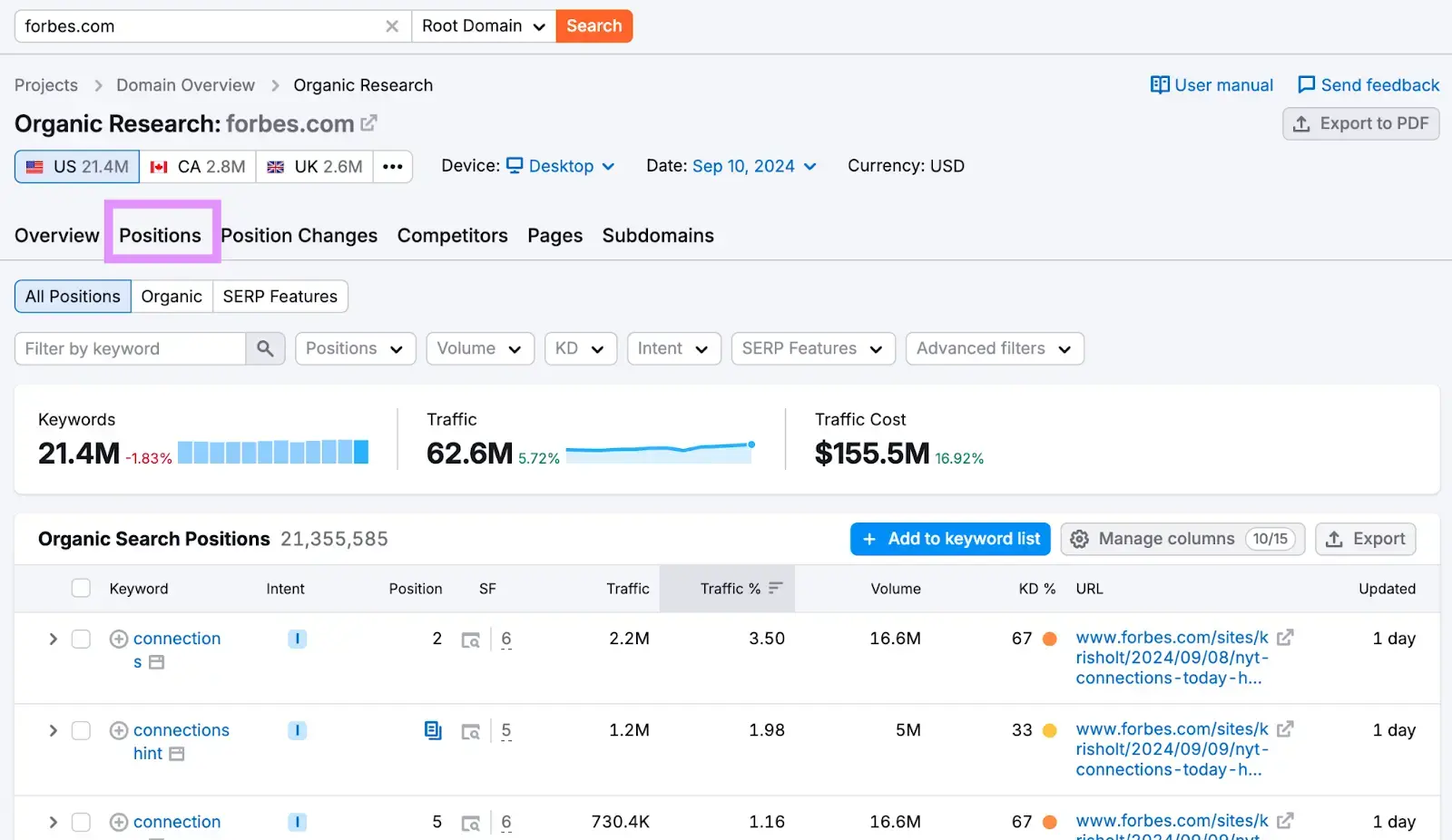

Rankings measure your website's position in search engine results pages (SERPs) for specific keywords.

Other SEO performance metrics include your website’s authority, backlinks, and overall organic traffic.

💡Higher rankings and better SEO performance than competitors mean your website appears above theirs in search results, potentially driving more organic traffic and leads to your site.

Tools like Semrush help you check competitors' keyword rankings, authority, and backlinks and compare them with your site

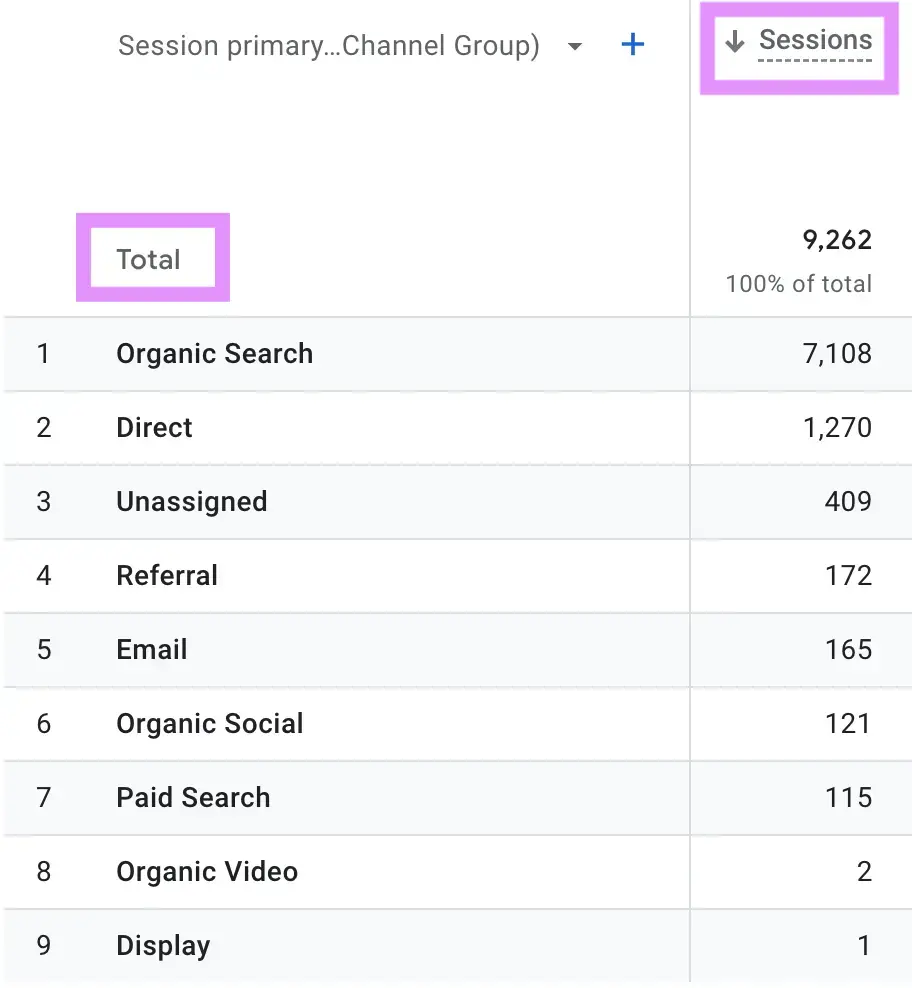

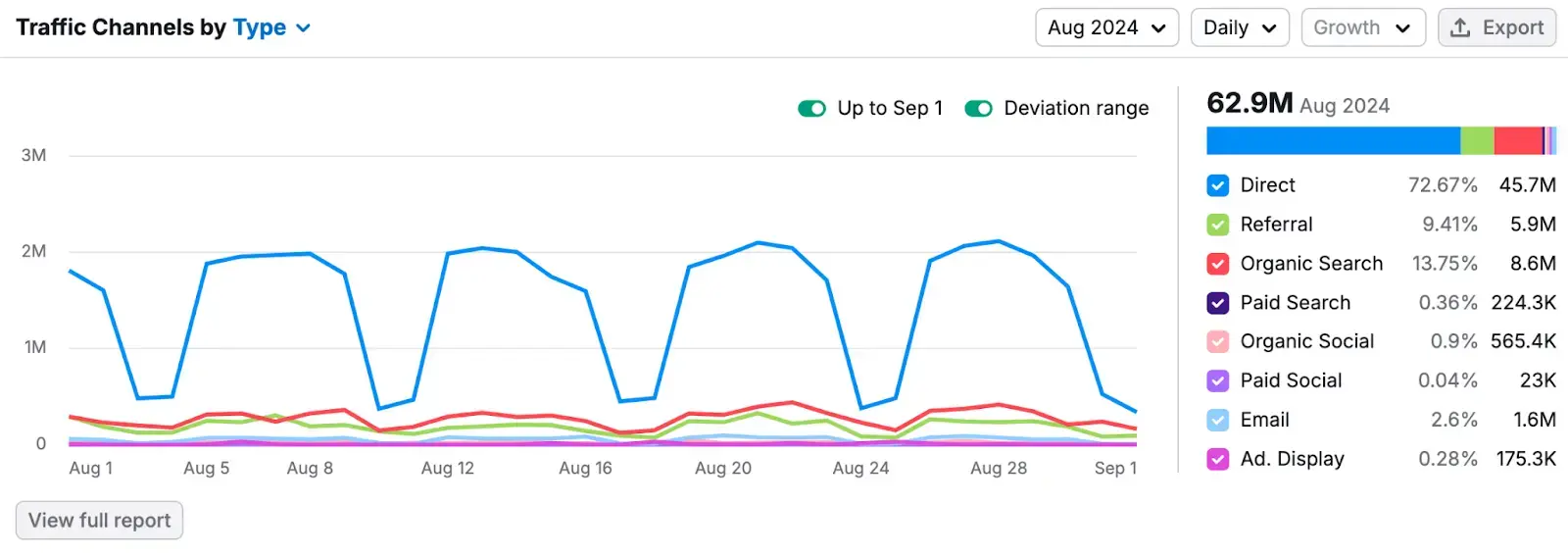

Web traffic by sources

Web traffic refers to the number of visitors your website receives over a specific period.

Traffic sources indicate where these visitors come from, such as organic search, direct visits, referrals, or social media.

💡 Comparing your traffic sources with competitors helps you spot untapped channels and evaluate the traffic potential for your niche.

Here’s what the traffic acquisition report looks like in Google Analytics (GA4):

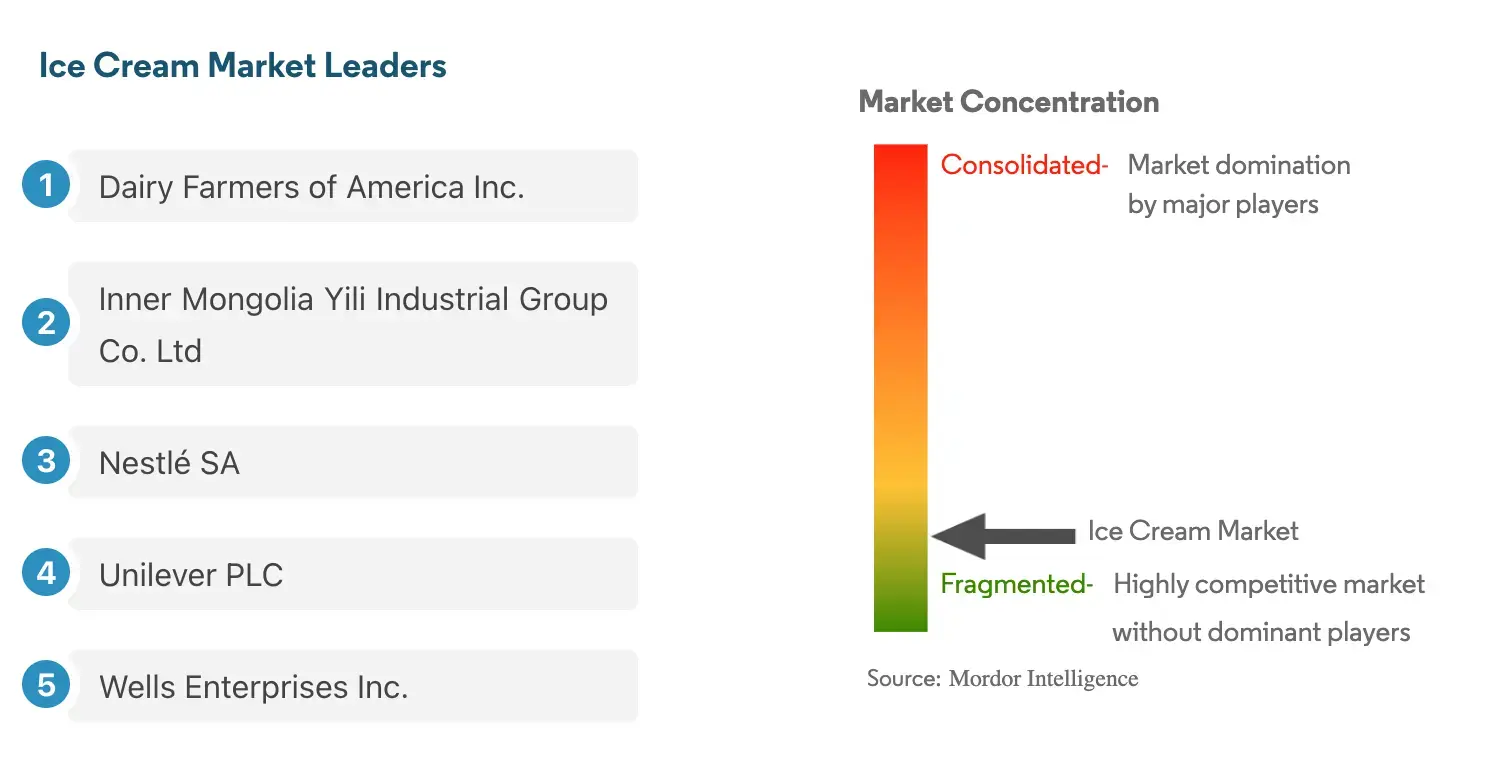

Market share

Market share shows the percentage of total sales in an industry generated by your company or your competitor.

To calculate it, divide a company's sales by the total sales of the industry over a specified time period:

Market Share = (Company's Sales / Total Industry Sales) x 100

💡 A higher market share compared to competitors suggests a stronger position in the industry. It often translates to greater economies of scale and brand recognition.

Here's what an industry report calculating the market share of ice cream brands looks like:

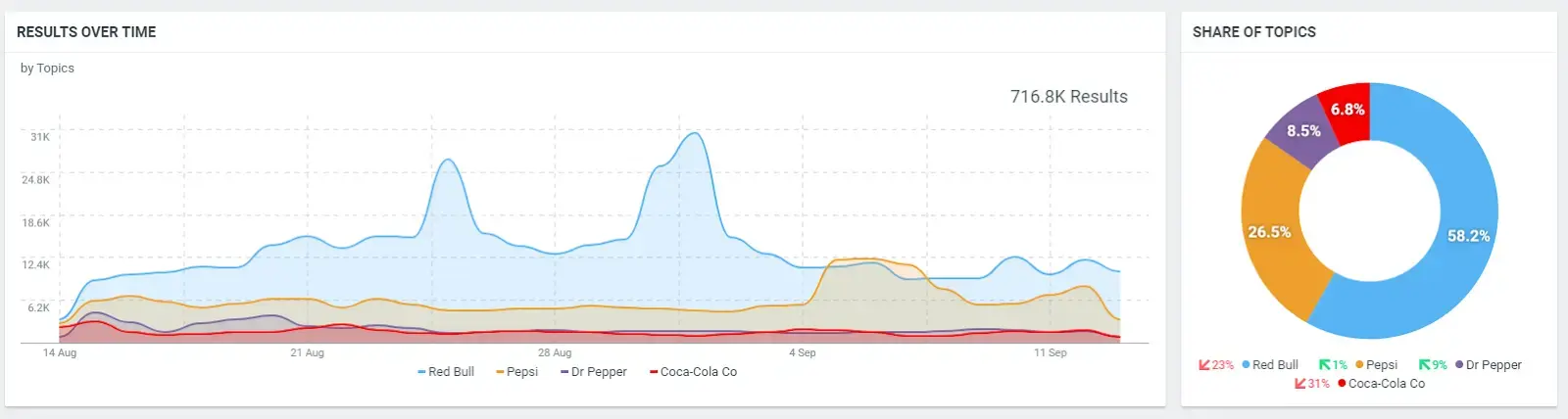

Share of Voice (SOV)

Share of Voice (SOV) is a measure of the market your brand owns compared to your competitors.

In marketing, you would typically define it as the share of conversations generated around a brand and its offerings—compared to direct competitors.

You can calculate SOV for different channels, including blogs, forums, social media and news sites:

Share of Voice = (Your Brand's Mentions / Total Mentions in Your Industry) x 100

💡 A higher SOV indicates greater brand visibility and awareness in your market. It helps you assess the impact of your brand awareness campaigns and improve your communication strategy.

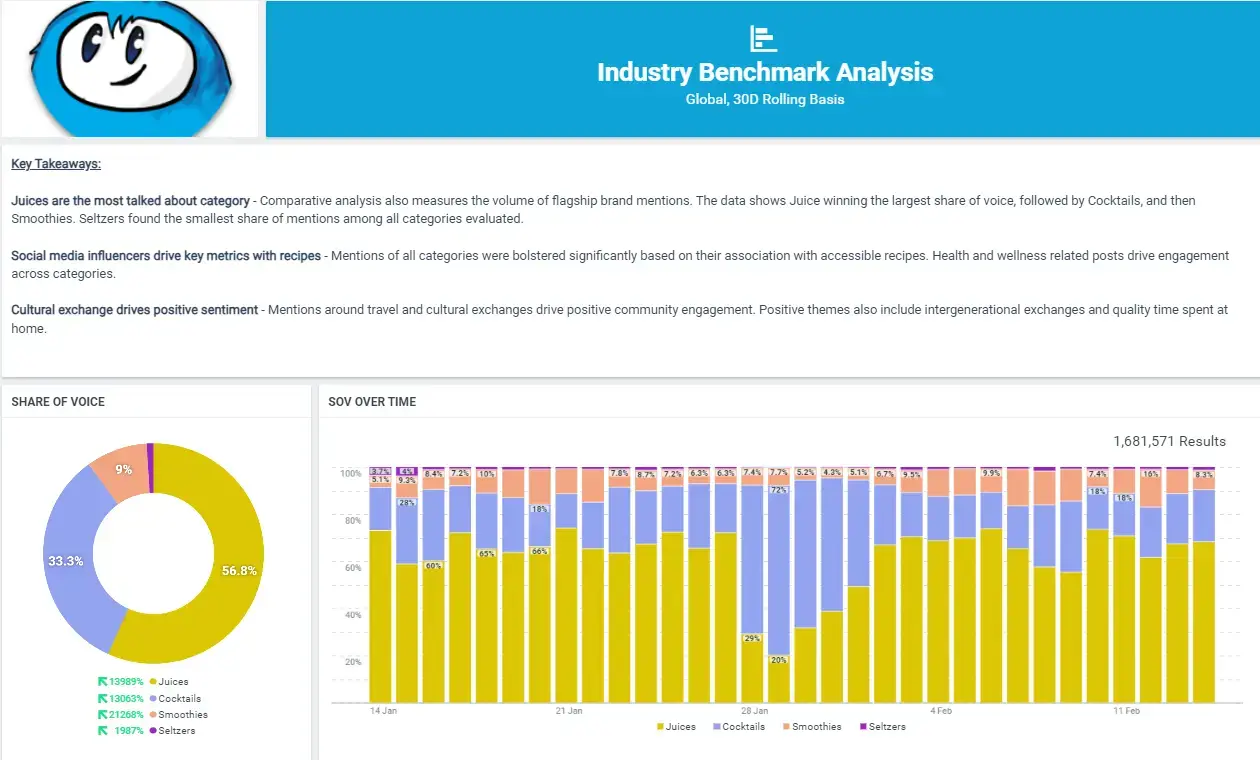

Here’s what a Share of Voice report looks like in Talkwalker’s

show brand sentiment insights using specialized dashboards:

Customer satisfaction and NPS

Customer satisfaction and NPS show how happy your customers are with your offerings and estimate their loyalty.

NPS is also a direct indicator of whether they are likely to recommend your brand to others.

Customer Satisfaction Score (CSAT) = (Number of satisfied customers / Total number of survey responses) x 100

NPS = % of Promoters - % of Detractors (Where Promoters score 9-10, Passives 7-8, and Detractors 0-6 on a 0-10 scale)

💡 Comparing your customer satisfaction and NPS scores with competitors provides insight into relative customer loyalty and advocacy.

Higher scores suggest stronger customer relationships, which can lead to increased retention and word-of-mouth marketing.

How to do competitive benchmarking in 9 steps

List your direct and indirect competitors

Start with identifying the key rivals you will analyze:

Direct competitors: These are businesses that offer similar products or services to the same target market.

Indirect competitors: These are businesses that may offer different products or services but compete for the same customer base or solve similar problems.

Use various research tools like Google Search, industry directories, and social media analysis to put together your list of rivals.

You can also survey your customers and use social listening software to see which brands your audience mentions alongside yours.

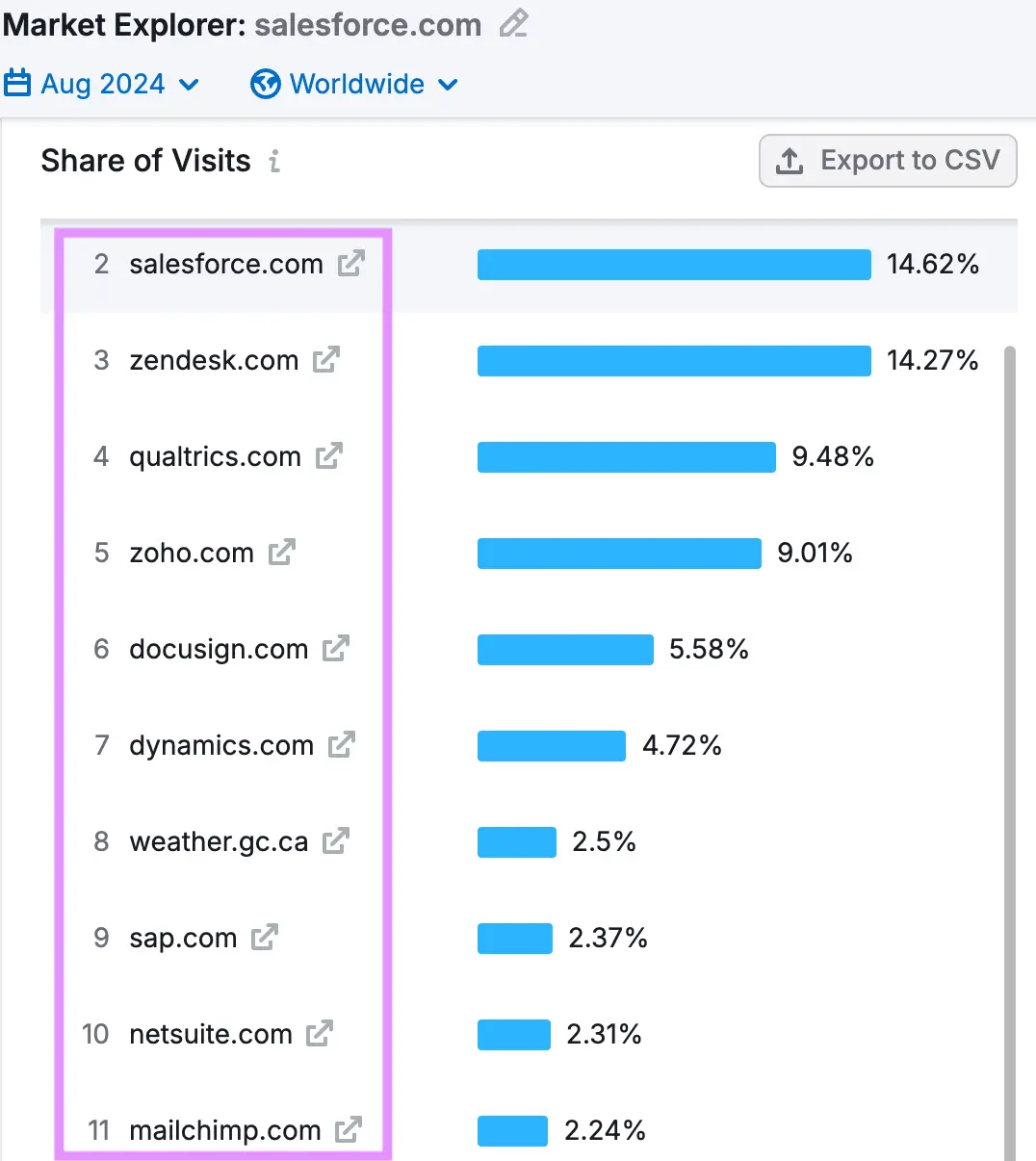

Finally, there are specialized tools like Semrush's Market Explorer . It identifies your online competitors based on the web traffic.

You’ll need to input your domain and it’ll generate a list of competing websites:

2. Prioritize the metrics you will track

Next, select the specific metrics you will focus on.

Start by reviewing the key metrics we discussed earlier: social media engagement, SEO performance, web traffic sources, market share, share of voice, and brand sentiment.

Consider which of these align most closely with your current business goals and challenges.

For example, measure social media engagement and traffic if you’re after improving your digital marketing performance. Or, prioritize market share if you want to enhance the overall business strategy.

There are other competitive benchmarking metrics you might select based on your goals, such as:

Employee satisfaction

Customer retention

Customer service metrics like response times

Product review scores

And more.

3. Estimate the market share

Now it’s time to estimate your and your competitors’ market shares. Here’s how you can do it:

Start by determining the total size of your market (the revenue or units sold).

Gather data. For public companies, use annual reports. For private companies, rely on industry reports or market research.

Divide each company's sales by the total market size and multiply by 100.

In the absence of sales data, use metrics like web traffic or social media followers as rough indicators of market presence.

For example, the Market Explorer tool we mentioned before shows yours and your competitors’ share in web traffic:

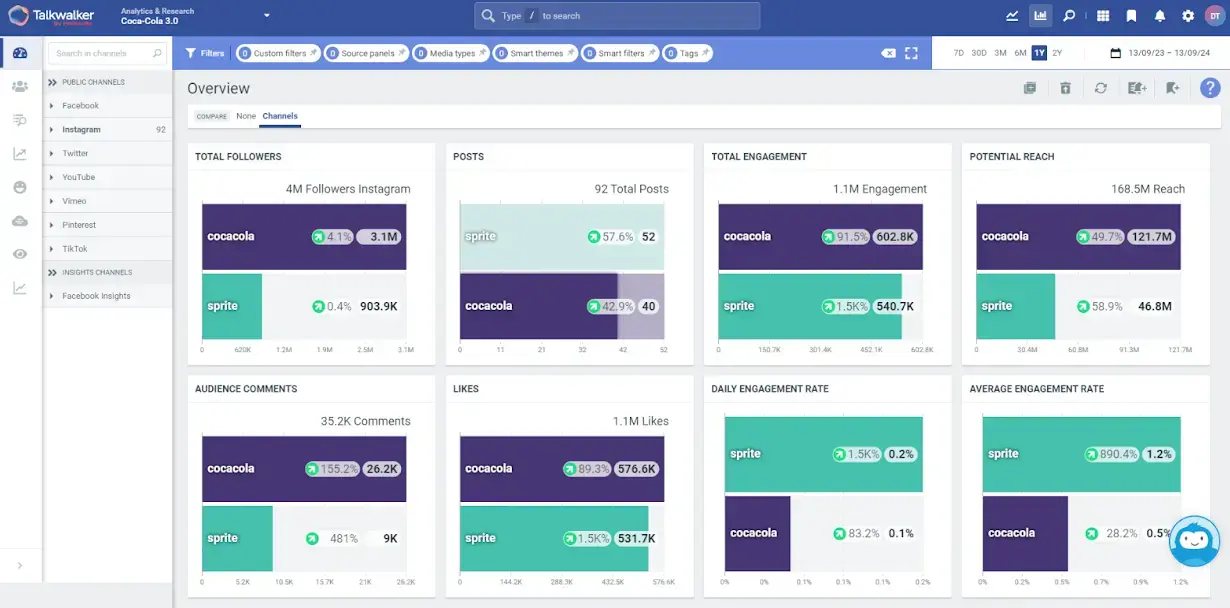

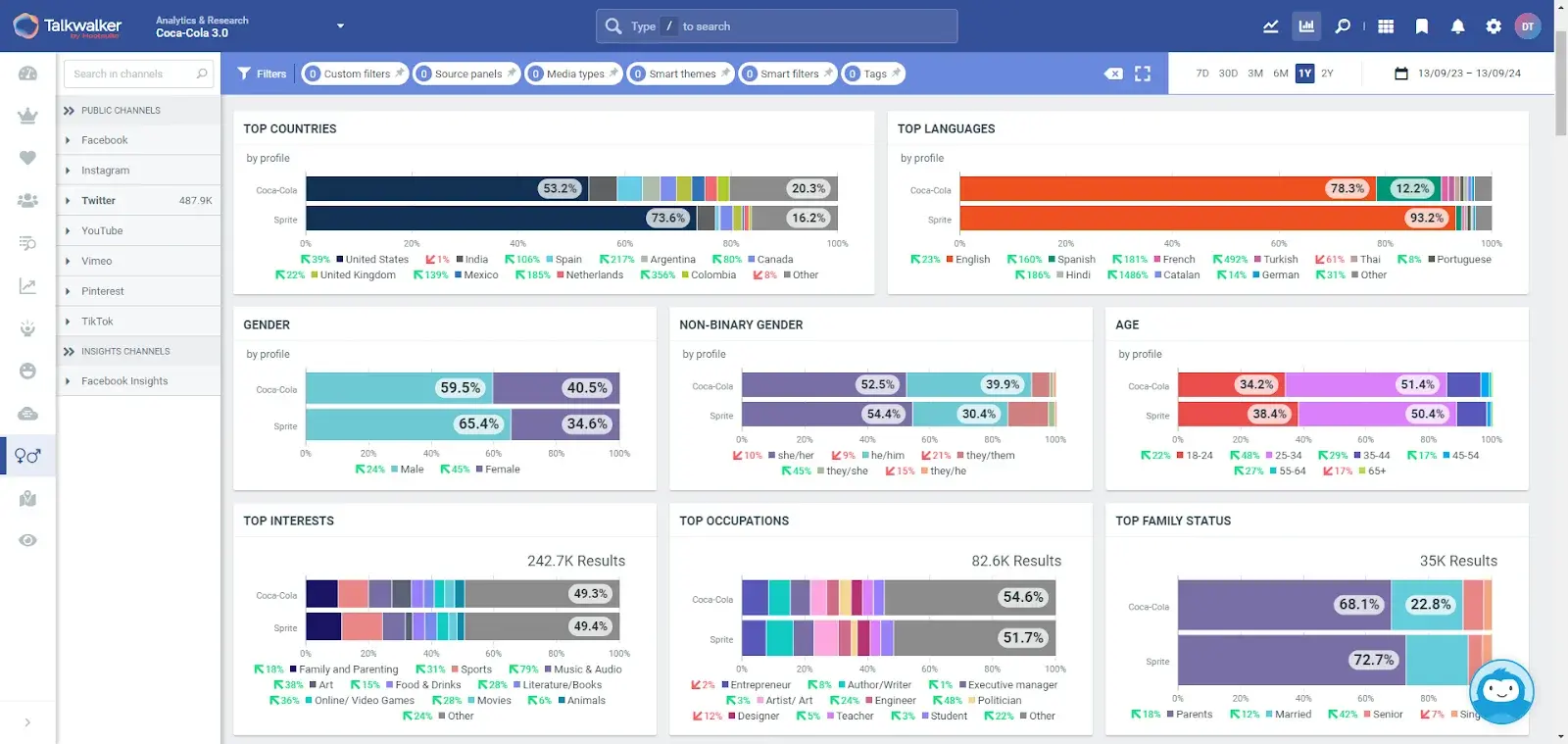

You can also use Talkwalker’s Social Benchmarking tool to check the “social media market share” of your competitors.

The tool takes into account the number of followers, published content, audience engagement, and reach over time.

This gives you an idea of how your brand stands against your rivals on social networks.

4. Benchmark social media presence

Next, analyze your and your competitors’ social media presence.

Here’s what you should look at:

Posting frequency: How often your competitors post on each platform. This can help you set benchmarks for your own posting schedule.

Key social media metrics: Engagement rates, follower growth, and sentiment.

Platform comparison: Performance and engagement on each social platform, since your competitors’ strategies might vary across channels.

Content performance: Which content types and topics are performing well for you and your competitors.

Audience profiles: How your audience demographics compare to your competitors’ and industry standards.

Remember, social media is highly dynamic. And your benchmarking analysis should be an ongoing effort.

To automate it, use tools like Talkwalker Social Benchmarking.

It helps you benchmark how your social media strategy is performing against competitors and industry standards.

For example, you can track your competitors’ engagement, followers, reach, and more over time.

You can also get essential information about their social media audience profiles—and use it to inform your strategy.

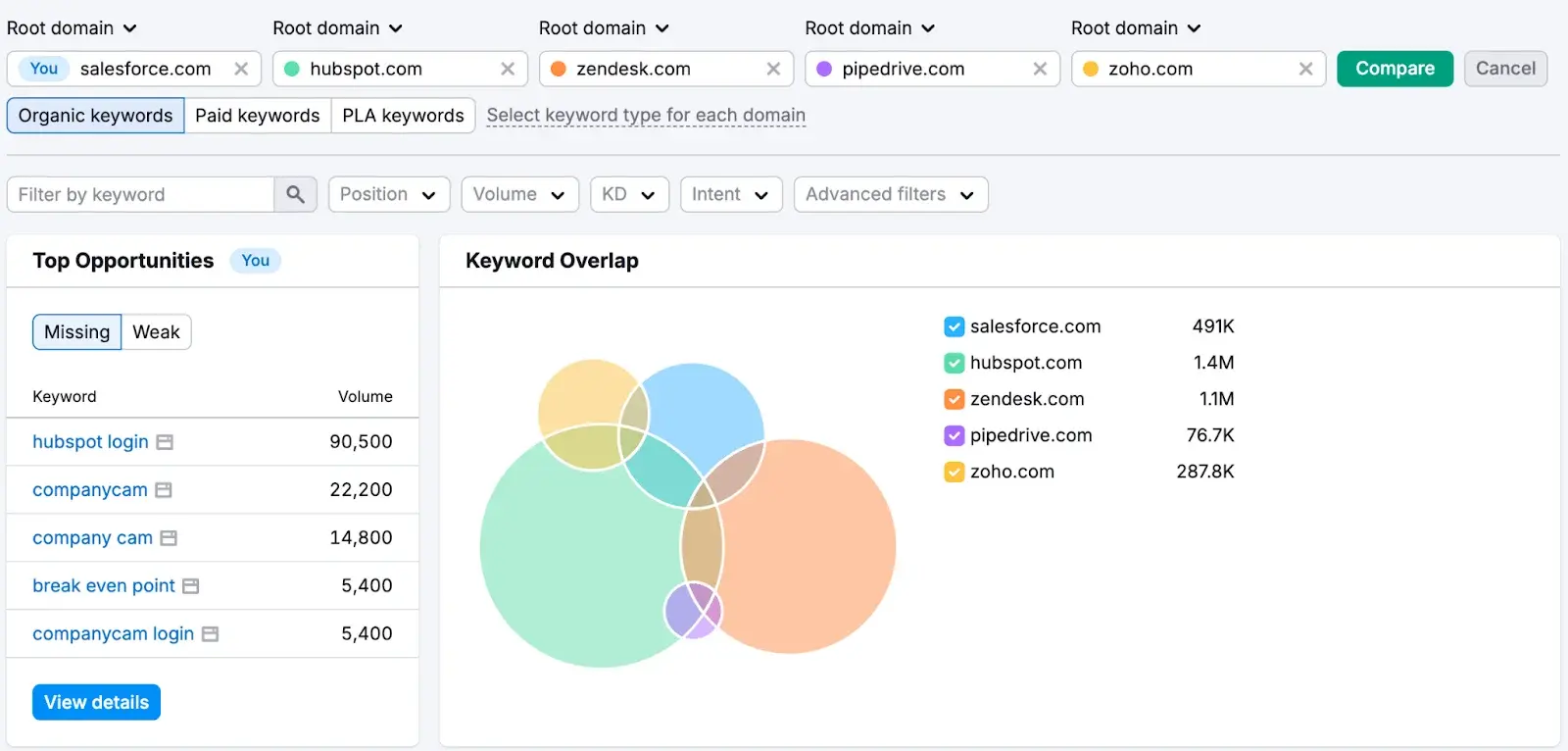

5. Examine keyword rankings

Keyword gap analysis helps you pinpoint the strengths and weaknesses of your SEO strategy.

You can use it to find opportunities for targeting attractive keywords with new content.

It might also reveal the need to update your existing pages to outrank the competition.

Use tools like Semrush’s Keyword Gap to implement this step.

First, add your domain and your competitors' domains:

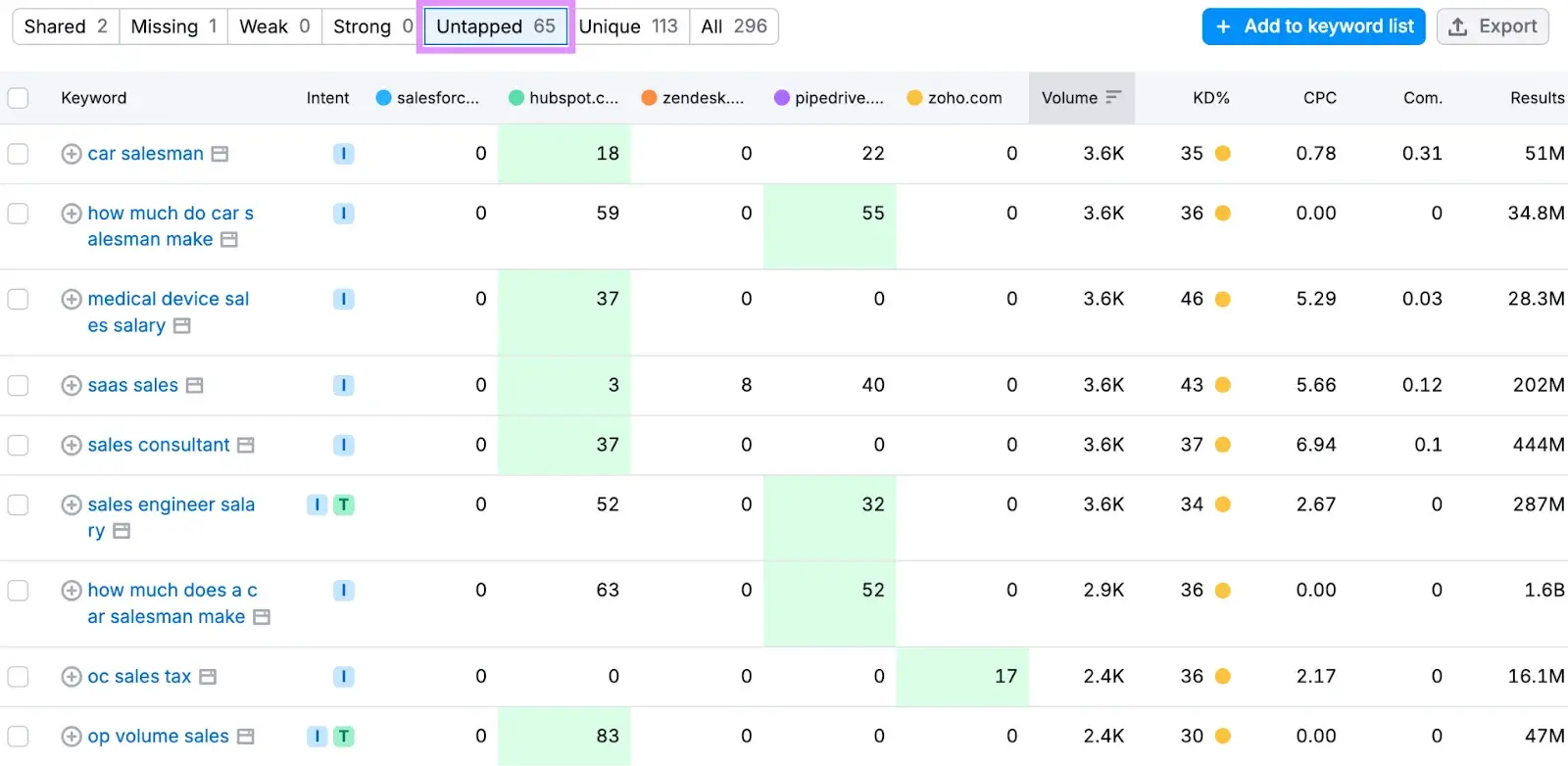

Then, scroll down to see various types of keyword comparisons.

For example, the “Untapped” report shows keywords at least one of your competitors ranks for while you don’t.

Then, use these insights to add new topics to your content plan and prioritize pages for content updates.

6. Analyze web traffic and its sources

Benchmarking web traffic generates important insights for your marketing strategy.

It shows you the traffic potential you can achieve in your niche. It also suggests the channels that work best for your competitors.

Here’s what you should look at:

The overall traffic and trends over time

Traffic sources (direct, organic, paid, social, referral, email)

Geographic traffic data

On-page engagement metrics (e.g., average visit duration)

Top pages that generate the most traffic and engagement

Devices (e.g., mobile vs desktop)

You can check all these metrics for your website using Google Analytics (GA4).

However, you’ll need a specialized competitive analysis tool to track them for your rivals.

Use solutions like Similarweb or Semrush’s Traffic Analytics tool.

Simply input a competitor’s domain and check their key traffic sources like direct, referral, and organic.

Use this information to revise your channel mix.

For example, if you see that your competitors attract a lot of organic traffic—and you don’t—it might be an indicator that you need a stronger SEO strategy.

7. Evaluate Share of Voice (SOV)

Next, measure how your brand's presence stacks up against your competitors across various channels.

This might include collecting and analyzing media mentions, social media conversations, forum posts, and more.

You can also go beyond basic calculation and:

Analyze sentiment (positive/negative/neutral)

Consider the nature of the publication (e.g., Wall Street Journal vs. niche blog)

Assess the prominence of your brand in mentions (title, passing mention, main topic)

You will also need a specialized tool to implement this step.

Here’s how to do it with Talkwalker.

First, set up dedicated topics for your brand and for your competitors.

Next, use the Analytics dashboard to analyze results over time.

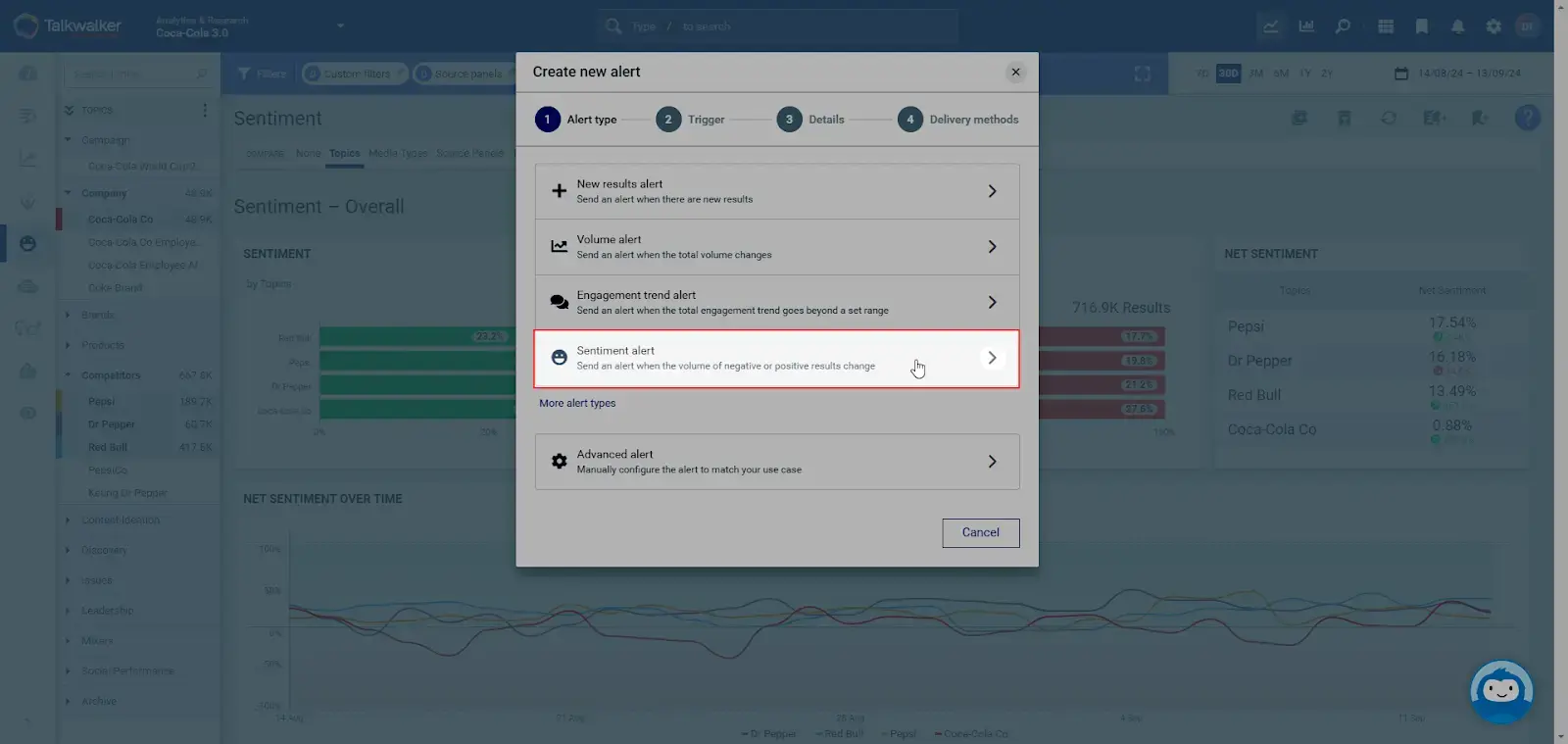

8. Analyze sentiment

Sentiment analysis checks how often your brand is mentioned online and how it’s perceived compared to competitors.

It uses advanced natural language processing algorithms to analyze the tone and emotional context of text mentions across various online platforms, from social media to forums.

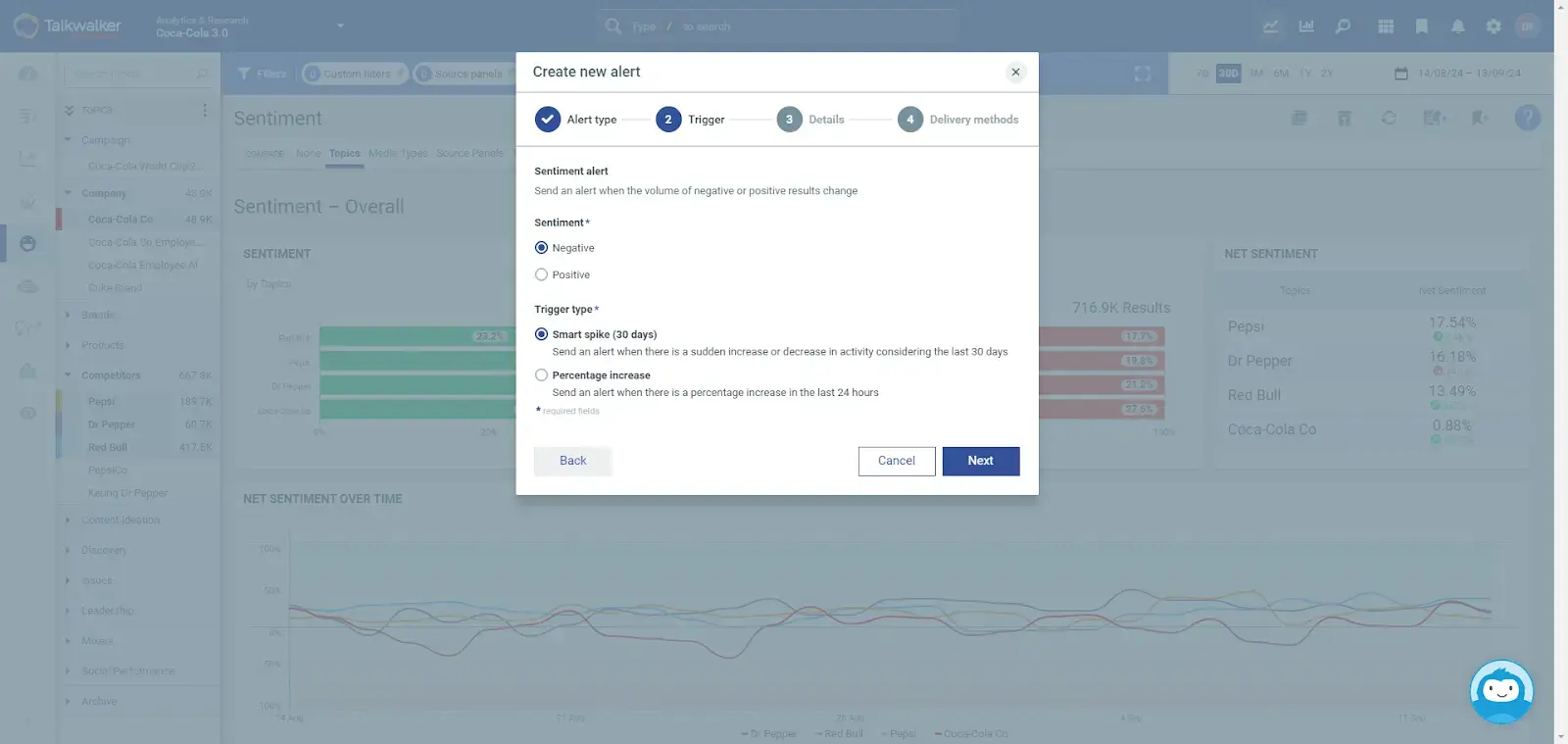

You can set up instant alerts to track sentiment changes as they happen—for your brand and for your competitors.

While it sounds complex, it’s very easy to set up using tools like Talkwalker’s Media Monitoring.

First, open the tool and set up a sentiment alert. It’ll trigger notifications when the volume of negative or positive results change.

You can then choose whether you want to track negative or positive sentiment changes and set up the trigger.

9. Estimate NPS and CSAT benchmarks

To benchmark Net Promoter Score (NPS) and Customer Satisfaction Score (CSAT), start by measuring your own metrics.

For NPS, survey your customers asking how likely they are to recommend your product or service on a 0-10 scale. Calculate your score by subtracting the percentage of detractors (0-6) from promoters (9-10).

For CSAT, ask your customers about their satisfaction on a 1-5 scale and calculate the percentage of 4 and 5 responses.

You can use various product analytics tools like Userpilot to create and distribute NPS and CSAT surveys.

Accessing competitor data for this purpose is more challenging. But not impossible. Here are some ways you can approach it:

Look for public financial reports or investor presentations where companies might disclose their NPS or CSAT scores.

Check industry benchmark reports on customer satisfaction

Monitor review sites like Trustpilot for aggregate ratings that can serve as CSAT proxies.

Use social media sentiment analysis as a rough indication of customer satisfaction levels.

For example, Talkwalker’s sentiment analysis provides a realistic view of what your customers think of your brand. And what they say of your competitors.

Build a smart strategy for your business

Keeping an eye on your competitors helps build a smarter strategy and differentiate your brand.

Competitive benchmarking is an essential part of this process. You can use it to establish realistic KPIs and find ideas for your marketing plan.

To make it work, use specialized tools that automate repetitive tasks and source essential insights.

For example, Talkwalker’s Social Benchmarking generates data about your competitors’ social media presence and compares it to your own.

Ready to give it a try?

{{cta('92303005422')}}