In this blog, I explore the major US food industry trends and identify what food brands should be aware of to optimize their strategies and get closer to their customers.

Sustainability is leading US Food industry trends

Sustainability is an ever growing trend around the world. In the US, it has taken on many different forms in a variety of industries, including CPG food and beverage. At the same time, fast food is still the most popular type of eating in the US (followed closely by Japan).

Millennials and Gen Zers are leading the charge when it comes to ‘sustainable eating’ and 'mindful drinking,' demonstrating a shift in consumer behavior away from simply cutting back or cutting out, toward more proactive, healthy food and beverage choices. Over the past year, the long-standing fast food custom in the US has been revolutionized by this sustainability trend, mainly through plant-based proteins.

In the past 3 months alone, a majority of the most popular fast food chain restaurants have introduced a plant-based meat option, including most recently, KFC that partnered with food industry giant Beyond Meat to create their plant-based fried 'chicken'.

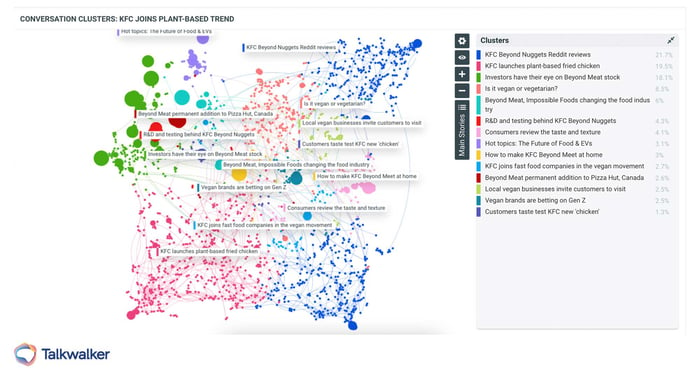

Conversation Clusters - The growing food trend in the US toward more sustainable and plant-based foods is only set to continue.

KFC's Beyond Nuggets launched on January 10 across the United States, and since then has already generated 15.6K social mentions and 210.6K engagements.

KFC’s Beyond Fried Chicken tastes like scrumptious chicken… but it’s made of plants! Available for a limited time only.

— KFC (@kfc) January 10, 2022

Other chains like Panda Express have done the same, also partnering with Beyond Meat to create their Beyond the Original Orange Chicken (or BTOOC). AMC Theaters also recently launched a partnership with other food industry giant Impossible Foods to create Impossible chicken nuggets for their moviegoers in hundreds of AMC theaters nationwide.

It should come as no surprise that many of these fast food plant-based protein announcements came toward the end of 2021, just in time for 'Veganuary.'

Started by a UK-based non profit in 2014, Veganuary is a way for consumers to lower their consumption of animal products during the month of January, as a fresh way to start off the New Year. For many, it is a popular and powerful New Year's resolution to be healthier and help the planet.

Across the Americas (US and LatAm), Veganuary received 1.1M engagements across all online conversations, starting just before the new year, with an overwhelming positive sentiment of 49.6%.

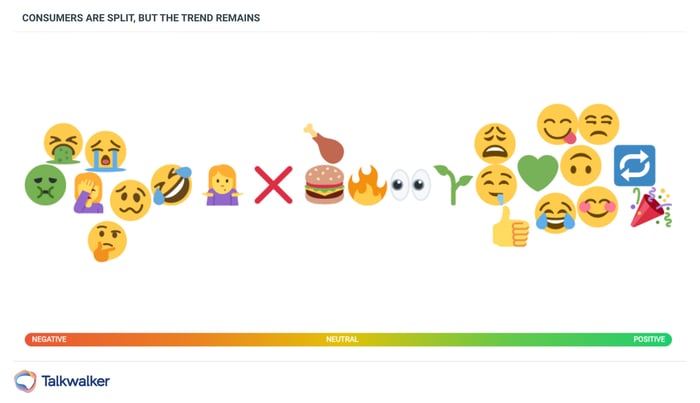

Looking at the top emojis used in social conversations, the vote is fairly evenly split between positive, neutral, and negative reactions.

Even though consumer sentiment is almost evenly split on this topic, the frequency and engagement with online conversations does indicate that both brands and consumers have their eye on KFC and other plant-based meat ventures. Consumers are looking for healthier food options overall, including in their fast food.

Regardless of how much consumers do or don’t like these new products, it is a significant US food industry trend that brands as influential as KFC are listening to the landscape and launching new products to suit it.

In fact, in January, the topic of sustainable eating has received 379.9K engagements, mainly from consumers ages 18-34.

The 'Future of Food' is a growing hot topic, with many investing in Gen Z consumers to influence and support the vegan/sustainability movement. It's clear that the younger generations value sustainability as a top issue. With 49% of support for sustainable eating coming from Millennials and 32% coming from Gen Zers, they are making it the preeminent US food industry trend.

Consumers love coffee at home

With the pandemic still keeping many individuals working from home, at-home coffee solutions have become even more popular.

Many consumers have embraced new at-home coffee rituals, experimented with new coffees and machines, and even attempted to replicate their favorite coffee shop drinks. Over the past 6 months, the number of online conversations surrounding coffee at home have significantly increased, totaling 264.6K with 1.9M engagements.

In addition to working from home, another reason for the spike was the holiday season, with Nespresso in particular included in many lists for best gifts and holiday deals.

Over the past 6 months, the number of online conversations surrounding coffee at home have significantly increased, totaling 264.6K with 1.9M engagements.

In this conversation cluster, you can see the different conversations associated with Nespresso, including Nespresso's customer service, custom coffee recipes, and debates over which coffee maker is the best on the market.

It's important to recognize that when analyzing online conversations on US food industry trends, consumers don't only interact with a company's brand or official branded content. They also engage with competitors, discuss unofficial content related to the brand, partners, influencers, official ambassadors, and more.

Looking at the top themes related to coffee at home, the discussions around coffee machines and coffee pods continues, with Nespresso and Keurig featured within the top ten themes.

One other interesting trend is the share of conversations, engagement, and sentiment by media platforms.

YouTube wins share of engagement of online conversations around coffee at home by a large majority with 1.1M of the 1.5M engagements over the past 6 months, followed by Twitter with 397.1K.

However, when ranking by sentiment, Facebook is the majority winner with 80% positive sentiment, followed by Instagram (71.2%), and then YouTube (42.1%).

Better-for-you beverage is a growing US food industry trend

As shown in our recent Birdseye Report on food trends, created in partnership with Twitter, Millennial and Gen Z consumers are pushing major legacy brands to innovate in the food industry and inspiring new brands to enter for the first time. Just like with fast food, sustainability and personal health are also top concerns for consumers when selecting beverages. People want drinks that are both good for them, and good for the planet, focusing on higher quality, rather than higher quantity.

Over the past ten years, the sale of non-alcoholic beverages has dramatically grown and fermented drinks still represent the biggest share of conversation in this industry.

Powered by Millennials and Gen Zers, fermented drinks still overwhelmingly win share of engagement with 91.4%.

This demonstrates a change in consumer behavior away from simply cutting back or cutting out, toward more proactive, healthy food and beverage choices.

The beverage industry is extremely competitive, but some brands are still finding success in cutting through the clutter, paying attention to these shifts in consumer concern, consciousness, and habits.

Creative crossovers is the future of drink

Coca Cola's sub-brand Simply Lemonade announced on January 25 that they will be launching a line of 'Simply Spiked Lemonades' in Summer 2022.

It's happening. https://t.co/Zav8xWevel

— Molson Coors Beverage Company (@MolsonCoors) January 29, 2022

The CNN article sharing this announcement received massive global reach in just two days, with 43.7M potential reach and 7.3K engagements.

This launch is the latest addition to a newer fourth beverage category, flavored alcoholic beverages (FAB) or alcoholic crossovers. This category has been most known for hard seltzers, with other recent additions of hard kombuchas and hard coffees.

Download the Birdseye Report about US food industry trends and learn about what you can do starting now to take full advantage of consumer insights and stay one step ahead.