Market uncertainty and the impact of global events remain a major concern for the financial industry in the Middle East. However, the overall ecosystem creates the perfect mise en scene to seize long-term opportunities. Financial services providers in the Middle East must go big and bold in the future.

Through technology, data, and people, financial organizations could tackle challenges and create a sustainable brand for the future. It is imperative for the financial industry in the Middle East to continue its digital transformation while increasing its ESG efforts.

The Middle East financial industry will have to compete to attract qualified talent, as personnel explore new careers in other industries. Investing in people’s wellbeing and improving their work lives requires financial organizations to reimagine the traditional workplace.

Furthermore, financial institutions in the Middle East will create new forms of partnerships to grow and uplift the entire industry. Cross-sector collaborations and partnerships will create an environment of trust and long-term agility. Providing a stellar customer experience will become the top priority instead of focusing on developing the newest financial products.

The financial industry in the Middle East will have to create frameworks that achieve financial gains while also benefiting society. Focusing on profit margins alone provides a narrow view of the success and impact of a financial institution.

Reducing the carbon footprint, driving sustainable finance, or embracing DEI are no longer short-term marketing campaigns, they are the future. Finding a new purpose and establishing trust with consumers enables the Middle East financial industry to reach new heights.

Talkwalker had recently published ‘Shape Tomorrow’, a white paper examining how consumer connections will shape the future of brands. The white paper examines the evolution of the gap between consumers and brands across industries. Shape Tomorrow identifies the obstacles hindering brands from preparing for the future.

Download Shape Tomorrow white paper

Shape Tomorrow: How ready is the Middle East financial industry?

The Middle East financial industry had to overcome numerous obstacles to reach today’s level of maturity. The Middle East financial sector lagged behind other emerging markets because of the lack of digital infrastructure, outdated regulations, and delayed market readiness. Nowadays, the financial sector in the Middle East is undergoing a paradigm shift.

Innovation in finance has been made at every level to make the industry more customer-centric and data-driven. Though, what’s interesting is that finance is turning into an ecosystem with multiple stakeholders who work together. Digitalization of financial services lies at the heart of this new market dynamic in the Middle East finance sector.

Banking-as-a-Service (BaaS) is the connecting link between legacy players in the financial industry and new disruptors. Banks will transform themselves from within to be holistic platforms built on top consumer data.

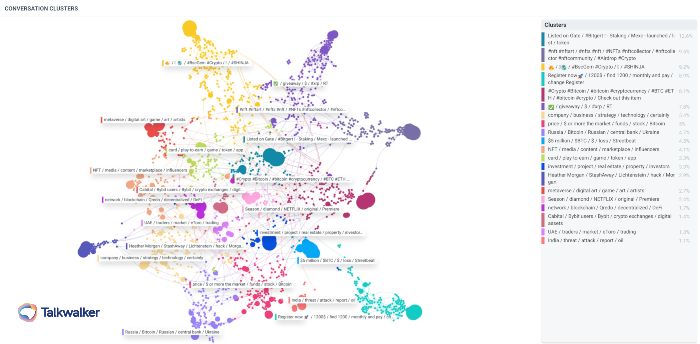

The top themes surrounding ‘Banking-as-a-Service’ in the Middle East during the past 30 days

In an era of connectivity and open banking, consumers will benefit from more modularization of financial services with more options and flexibility with their financial planning.

"Finance and banking are going to become even more digital, focused on youth and financial empowerment. We will see banks’ business models become more platform-based rather than product-based," said Ahmed Soliman, Marketing Manager at Abu Dhabi Islamic Bank.

The future of the Middle East financial industry will be hugely shaped by the prominence of digital payments, cryptocurrencies, and central bank digital coins. For example, Saudi Arabia’s STC Pay, Al Rajhi Bank’s UrPay, and other fintech players are challenging established incumbents in that space.

Talkwalker's Conversations Clusters showing social media conversations related to 'crypto' from the GCC market between September 2021 and March 2022.

Plus, Project Aber is a cross-border partnership between the UAE and Saudi Arabia on cryptos that revolutionizes the way interbank transactions and reserve management occurs. The UAE and Saudi Arabia have partnered with IBM to explore ways to make settlements using a single regional currency.

Furthermore, financial institutions in the Middle East are increasingly relying on artificial intelligence, predictive analytics, and algorithms in their daily operations. As a result of this fiscal consolidation, more efficiency is achieved and companies can do business easier. By having real-time analytics of every transaction, financial service providers can innovate more efficiently and ensure stronger tax compliance.

In short, the financial industry in the Middle East is poised for a radical transformation in 2022. Financial institutions will allocate budgets to achieve long-term growth and operational resilience, in addition to ESG-focused investing and policies. This transformation is underpinned by three elemental pillars that financial service providers must focus on to prepare for the future: data, technology, and people.

Download Shape Tomorrow white paper

The future belongs to those who prepare for it today

The relationship between consumers and financial service providers in the Middle East will determine the future of the industry. Therefore, it is critical that financial services marketing plans include understanding what consumers need and acting upon it. The old adage says that historic data cannot predict future trends, though it surely can help shape them.

The financial industry in the Middle East must get close to its consumer base. Meaning, financial service providers must become proactive where they anticipate consumers' expectations and financial aspirations. One could think of today’s consumers as the blueprint of tomorrow’s.

Closing the gap between consumers and financial service providers correlates to the gap between data, technology, and people. All must work together to give a clear picture of the consumers.

- Data: Financial service providers must solidify their data infrastructure in order to be able to shape tomorrow. Having the ability to collect, store, and manage the data effectively leads to making faster and better decisions. Forward-looking financial institutions must lay the foundation for real-time consumer data in a way that is not siloed.

- Technology: Data must be enriched to become actionable intelligence, and ultimately become insights. With the use of AI-powered solutions, the finance industry in the Middle East could make faster decisions and reliable predictions.

- People: Data intelligence alone might give an incomplete picture of the truth. Brands that will shape tomorrow must remain rooted in the cultural and societal context they belong in. Meaning, brands will continue to rely on industry experts to enrich the data with nuances and local knowledge that create customer-centric brands of tomorrow.

Conclusion: The financial industry in the Middle East is ready

The financial industry in the Middle East is growing at an unprecedented pace. The population is young, highly educated, digitally savvy, and more demanding. Therefore, financial service providers will need to not only diversify their products but also be swift to act on insights efficiently.