Read our report on the Global Financial Twitter (#FinTwit) community

With the use of machine learning and artificial intelligence (AI) to analyze the millions of data points generated via social media channels, and the ability to combine this with existing intelligence from customer databases and review sites, financial brands are also able to leverage consumer insights that could powerfully shape future products and offerings.

In this article, I explore the convergence of social media and banking, how social media analytics is used to enhance financial institutions, and more ways in which AI-powered consumer intelligence can help financial brands to unlock insights that deliver business impact.

Table of contents

1. Why social media is important for banks

2. How social media analytics in banking builds brand love

- Bottomline: Aligning industry and brand intelligence across teams

- Abu Dhabi Islamic Bank: Becoming UAE's top mobile banking app

- OneLife: Transforming digital marketing and business innovation practices

3. More ways for financial brands to use consumer intelligence

Why social media is important for banks

The prioritization of social media in banking and financial services is hard to dispute. Most consumers want to spend less time banking and investing, and more time enjoying what their money can buy.

Therefore to succeed in consumer engagement, banks use social networks to educate, influence, and reach out to their customers. Social media channels become a cost-effective means to scale up relationship management and brand awareness-raising for banks. When the time comes to make a deposit, or purchase a financial product, the brand-consumer passion and trust that is nurtured over time helps to win the check.

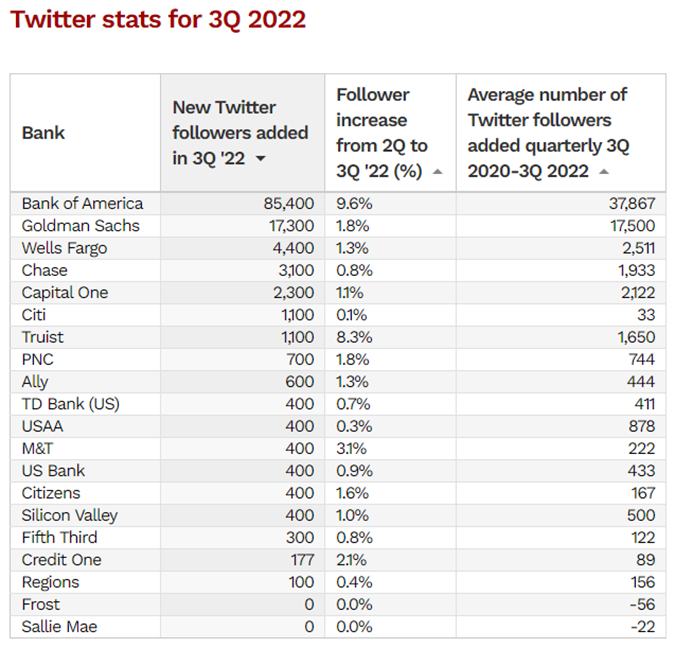

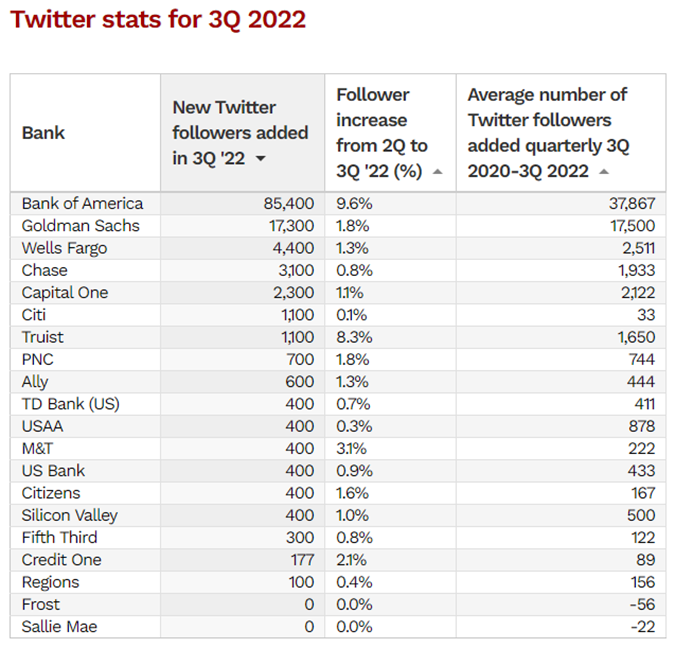

Top banks in the US expanded their followings by at least 30% on a quarterly basis in 2022, across platforms such as Instagram, Twitter, and YouTube. (Source: Financial Brand)

Given the tough competition on social media amongst financial brands, however, the effective use of social data will help set apart a most loved brand from the laggards in the long run. Whether it’s developing custom metrics, researching enterprise prospects, predicting consumer trends, or supporting data-driven innovation, the advanced application of social media analytics in banking is producing new use cases for social data that are becoming hard to ignore.

Find out how sustainability builds love for today and the future

How social media analytics in banking builds brand love

Social media exposes a brand to millions of interactions in a day, not all of which are positive or beneficial to building a loved financial brand. Given the need for heavy regulation and compliance in the financial services industry, banks need to be additionally vigilant about all brand-related communication.

In order to stay on top of conversation trends and consumer feedback, it’s vital to have real-time social media analytics in place for any financial brand.Social media analytics in banking is not all about reputation management, however. Below are three examples of banks and financial services that are pushing the envelope of what financial brands can do with social data

Bottomline: Aligning industry and brand intelligence across teams

Fintech brand Bottomline counts huge enterprises, including banks of all sizes among its international customer base. A lack of alignment and fragmented reporting, however, was complicating the use of insights across the brand’s various communication efforts.

Read the Bottomline case study

In this context, Talkwalker was brought in to provide a single view of industry intelligence, social media performance, and media placements. With the power of social listening, we could provide with a single source of truth for owned and earned media, as well as paid social channels, teams across Bottomline are able to

- Pinpoint emerging consumer trends

- Identify the most influential voices on key topics

- Track fluctuations in brand sentiment

- Accurately measure the performance of campaigns across channels

- Understand and identify competitor trends and their strategies

"We have our finger on the pulse of our PR and communications and are able to deliver beautiful data visualization and insights that answer business questions. It’s a very powerful, easy-to-use platform that allows us to streamline our global marketing approach"

- Jerry Nichols, Global Head of Marketing Analytics, Bottomline

Abu Dhabi Islamic Bank: Becoming UAE's top mobile banking app

A leading bank in the United Arab Emirates (UAE) and the 4th largest Islamic bank globally by assets, the Abu Dhabi Islamic Bank (ADIB) prides itself on delivering excellent customer experiences. A key differentiator of ADIB’s services is the bank’s all-in-one mobile application which services an average of 10 million transactions a month.

Given the high traffic volume on the mobile app, and the bank’s commitment to customer service excellence, Talkwalker was brought in to help improve the overall customer experience while using the app. The following measures were put in place:

- Real-time reports and alerts to address issues as they happen

- Leveraging AI-powered sentiment analysis to keep track of performance

- Using logo recognition in images to identify hidden brand mentions

- Create educational content that matches customer needs

“The UAE is a key market for us and it is ADIB’s home base. Customers expect the mobile app to be fast, efficient and do what it’s supposed to do: nothing more, nothing less. We had to match those expectations because our customers deserve the best customer experience”

- Ahmed Soliman, Social Media Manager, ADIB

OneLife: Transforming digital marketing and business innovation practices

A life assurance specialist in Luxembourg, OneLife offers cross-border financial planning, asset management, and wealth management services to high net worth clients across Europe and beyond. As part of its digital transformation journey, OneLife was looking to optimize its financial marketing strategy, and also steer its company culture towards a focus on innovation and data-driven business practices.

For OneLife, the first step towards transforming business culture was to modernize the company’s digital marketing approach. To that end, Talkwalker was brought in to enhance the company’s measurement culture across the board, starting with marketing. This helped to achieve the following:

- Set up real-time brand monitoring

- Enable tracking of region-specific topics and trends

- Optimize the use of online channels for brand building

- Deliver workshops and customized dashboards across teams, including Sales, Marketing, and Global Brandings

“We used Talkwalker not only to get new intelligence, but also to introduce a new mindset, to show our employees how they could use social data to create new opportunities.”

- Christophe Regnault, Digital Marketing Manager, OneLife

Talkwalker’s solutions helped the company scale to half a million daily impressions on the company’s official social media platforms, and familiarity with social data led to a steep increase in the Social Selling Index (SSI) of OneLife representatives, who continue to champion data-driven business practices.

Find out what Talkwalker can do for your financial brand

More ways for financial brands to use consumer intelligence

As you’ve seen from the above examples, social media analytics in banking is especially meaningful when used in conjunction with other internal and external data sets that are available to a brand, given the wide range of digital touch points. This could include reviews, surveys, CRM data, and more, which are available as integrations on the Talkwalker platform.

Insights from social data are also maximized when shared across teams, as real-time access to conversation trends and consumer feedback can be invaluable to teams (such as Product and Services, Sales, Innovation) with mandates that fall outside the purview of social media marketing teams.

Here are just two more ways in which financial brands can consider accelerating their consumer insights practice:

1. Custom metrics that help you measure what matters

Talkwalker’s Brand Love Index is a great example of how custom metrics can be developed to measure Passion, Customer Satisfaction, and Trust - the three qualities that are shared by most loved brands according to our research.

Clients such as Axiata Group have worked with ADA and Talkwalker to take this a step further and develop their own Digital Reputation Score (DRS), which helps measure and manage online reputation for Axiata operating companies (OpCos), combining both qualitative and quantitative data sources. The DRS system has helped amplify and streamline measurements of campaign impact, increase responsiveness to negative sentiment and scores, and enabled 83% of Axiata OpCos to achieve L5 (top tier) DRS performance in 2021.

Read our Decoding the connected Southeast Asian consumer study for more

2. Leverage large language models to reduce time-to-insight

Large language models (LLMs) are AI models with significantly larger neural networks (around 1,000x the average), pre-trained on vast sets of language data. This means they’re capable of performing a wide variety of tasks with little or no need for further training. These artificial neural networks are designed to mimic the complexity of the human brain, therefore, the larger the network the greater the brain power.

Talkwalker's Blue Silk™ AI applies large language models to two new features, Blue Silk™ Insight and 1-Click AI Classifier.

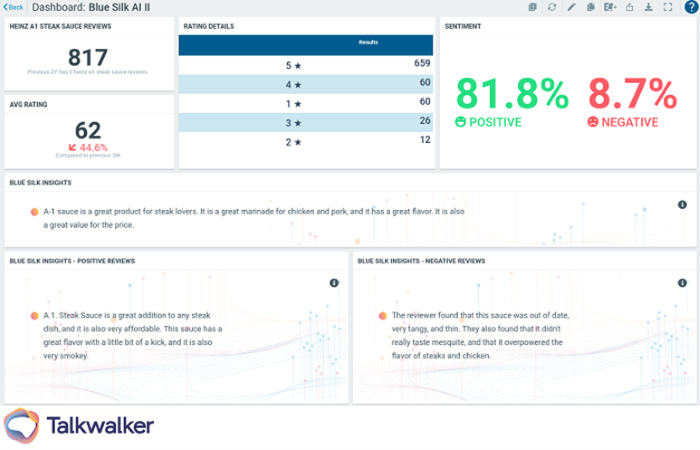

Blue Silk™ Insight uses the power of LLMs to do the hard work of reading through 1,000s of CSAT surveys, reviews, and customer support emails, and gives you the essence of all that feedback from a nuanced understanding of the human language. All the vital information you gathered is displayed in a handful of sentences, with no training of the AI model needed.

Blue Silk™ Insight - All your reviews are simplified into easy-to-understand insights.

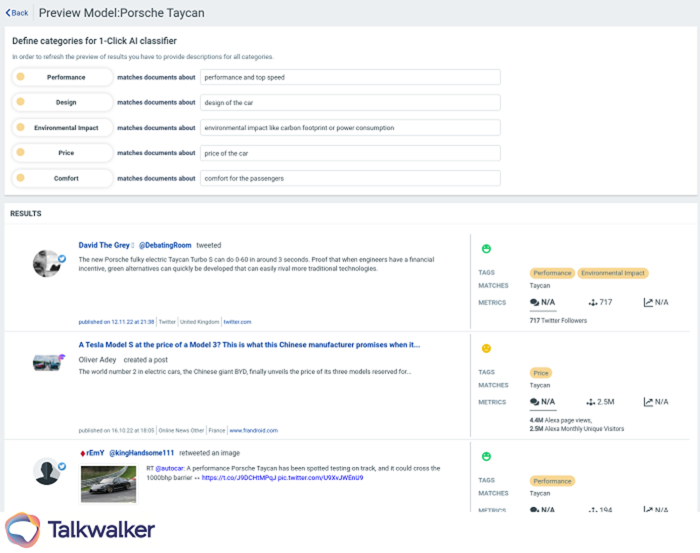

1-click AI classifier automatically segments and categorizes your data, sparing insight teams the trouble of manually complicated boolean rules or AI classifiers. This accelerates the treatment of large amounts of social data, with again no training of the AI model required.

Improved time-to-insight on social data classification using the 1-click AI classifier.

In order to enable data-driven business practices based on customer feedback, banks are increasingly looking for platforms that are able to unify their analytical needs, and break down silos across different teams. Talkwalker’s consumer intelligence platform is helping brands cut through all that data chaos, and reduce the time taken to realizing insights and business value from multiple data sources, and across formats including text, video, images, and audio.

3. Start using social media analytics for free

There’s no need to wait if you want to start analyzing social media analytics around your finance business. Talkwalker Free Social Search is a free tool that you can start using instantly to find out more about what’s happening in your industry.

There are other great social media analytics tools on the market, but Talkwalker is our favorite.

The finance industry is just one industry use case social media analytics can be used for. Speak to us to find out how people, data, and platforms can come together in any industry – in order to put consumers at the heart of your decision-making, embrace smarter innovation, create more successful campaigns, and provide enhanced customer experiences.