Download Talkwalker’s latest industry report on the fashion & beauty industry

Easier said than done, especially as most Middle East consumers like to physically hold the item in their hands before committing to buying it. Which makes sense, especially when it comes to makeup, luxury clothing items, or even a piece of jewelry. On the bright side, almost '70% of high-net-worth GCC buyers, who traditionally opt for in-store luxury shopping, now say they are comfortable with online shopping.’

While the shift to an online-first mindset among MENA consumers already had momentum before the pandemic, it wasn’t until they were forced to adapt that they finally accepted it. The same could also be said about MENA brands, who had previously thought of online shopping as an extra sales channel rather than their primary source of revenue.

To give a bit of context, shopping is more of a social activity in the Middle East and Africa region, rather than simply a means to an end. Particularly in the GCC region where temperatures reach 40°C in the summer and malls become a haven from the heat where people shop, eat, socialize, and consume.

Factors that influenced the fashion and beauty industry in the MENA region

The fashion and beauty industry is more dynamic than ever, particularly with Gen Z consumers driving the trends around what’s ‘hot and what’s not. That, added with the fact that MENA consumers are becoming more technologically savvy and connected than ever, means that brands now have the opportunity to have a 360-degree view of their clientele both online and offline.

Early during the pandemic, beauty and fashion industry players realized swiftly that to survive, they must establish a robust digital infrastructure that puts the customer at the center of their operations. The cornerstone of that digital infrastructure is consumer intelligence built on real-time data that is reliable and accurate. Consumer data was among the biggest factors that shaped the fashion and beauty industry in the MENA region during 2021.

Consumer intelligence will set you apart from the competition

Quantifying and measuring consumers’ taste in fashion has the potential to create endless opportunities for brands to profit and grow. Understanding how your consumers navigate your e-commerce app and interact with a clothing item or beauty item is the differentiating factor. Whether high-waisted jeans are back in fashion, or low-cut ones are the way to go. Or whether to push summer colors versus more timid earth-toned ones.

Unraveling the nuances between each customer segment has been a unique challenge for marketers, designers, supply chain managers, UX professionals, and more.

One thing is clear, MENA fashion and beauty consumers are becoming more individualistic and vocal about their choices. Brands must be able to transform their strategies from an ‘I have’ mindset towards an ‘I experience’ one.

Consumers are being empowered with knowledge and therefore turning less loyal to brands they once advocated for -- brands are responding to that shift by becoming more transparent and approachable. Also, with fewer tourists flying in, brands focused on online local buyers and therefore had to shift their strategies to the cosmopolitan composition of the MENA region, where many cultures and tastes live in one city.

Many forces are shaping the fashion and beauty industry; shape them

Both brands and consumers are aware of the changed relationship, and they are trying to engage in a different type of conversation, one that is based on trust, transparency, and instant gratification. Nowadays, MENA brands are treating consumers as equals, and therefore are creating direct communication channels on social media organically and through influencers.

Talkwalker’s Fashion and Beauty Industry report

Most recently, Talkwalker published an industry report titled ‘Fashion & Beauty - Reinventing style: a rise in comfort, tech, and the customer experience.’ The report lays out the overarching conversations that defined the industry between March-May 2021, and how brands maximized their reach with user-generated content, celebrity endorsements, and active consumer intelligence.

Furthermore, the report provides insight into how the pandemic led to the shift from beauty-focused products towards holistic self-care and wellness. Naturally, more people were staying at home and thus were looking for ways to soothe their pandemic-induced anxiety through comfy athleisure clothing, skincare tutorials, second-hand shopping, and AR-powered fashion runways (yes, that’s a thing now).

The report is highly beneficial for any market researcher looking to refresh their knowledge of the conversations surrounding fashion and beauty in the digital space.

Download the industry report now

Below I will attempt to bring the conversation closer to home to see how MENA-focused brands have responded to the ongoing shift in market behavior.

Benefit Cosmetics Middle East goes all-in for influencer videos

If you go to Benefit Cosmetics’ website, they say that they’re not only in the cosmetics business but also in the ‘feelgood’ business. The San Francisco-based company is painting all phone screens with their iconic hot pink through their use of videos across platforms, whether YouTube, TikTok, or Instagram (sorry tweeps).

Benefits Cosmetics engaged influencers to turn their video channels into platforms for wellness promotion and a resource of lifestyle-related things. Their most recent collaboration with Bahraini influencer Yara Ayoob is a clear example of how the brand is celebrating natural eyebrows ‘by association’. A self-identified visual artist and ‘gamer’, Ayoob spares no opportunity to flaunt her eyebrows

Sidenote: do Gen Z consumers still say ‘on fleek’? Find out now.

What’s even more interesting is how the brand has ridden the wave of user-generated content and tried to adapt it using its own line of products.

Benefit Cosmetics’ most engaging content all came from their official YouTube channel

Benefit Cosmetics was also ranked as the world’s fourth most loved brand in Talkwalker’s latest Brand Love Story for their strategic ability to show empathy with their user base and engage in meaningful conversations through video, influencer marketing, and user-generated content.

Huda Beauty: Started from the bottom now we’re here

When it comes to the beauty industry, establishing trust from the get-go is crucial for any brand’s long-term success and sustainability. This is precisely what Huda Kattan, the founder of Huda Beauty, did: focusing on quality content that is transparent and honest.

What seems to be the norm nowadays was revolutionary back in 2013, when Kattan advanced her social channels to become Huda Beauty the brand, along with its own line of products. Kattan’s ability to voice her opinion without being shaped by sponsorship money is what gave her credibility among her audience, and how she grew to a whopping 40 million followers on Instagram and 4 million subscribers on YouTube so far.

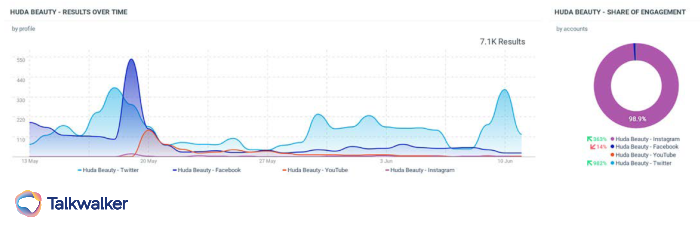

Knowing it’s a visually-driven industry, 99% of Huda Beauty’s 3.7M social media engagements came from Instagram during June 2021. Interestingly, Huda Beauty’s Instagram page posts the least amount of content compared to other channels like Twitter and Facebook -- highlighting that the audience preference goes to quality content rather than quantity.

Channel analytics indicates that consumers value quality over quantity - Huda Beauty Instagram generates the majority of the engagement despite having the least number of posts.

All data and forecasts show that the beauty and fashion industry in the Middle East is on the verge of unprecedented growth. Consumer preference is becoming increasingly multi-dimensional, shaped by various factors from across the globe. Also, Middle East consumers are no longer simply accepting everything that’s ‘Western’, but rather are adopting and accepting local brands as they are more in tune with the market’s needs and likes.

On the other side, brands are proactively engaging customers in direct conversations to seek clarity on their needs, concerns, and potential opportunities. Consumer intelligence is an irreplaceable asset for brands aiming to reach and benefit from incremental growth within a post-COVID market that’s riddled with uncertainty and vagueness.