Rise in over-the-top media consumption

As consumers spent more time indoors, naturally, the amount of time spent on movies and tv shows also increased significantly, leading to a spike in the volume of OTT media consumed. According to a study done by the Trade Desk and Kantar, 80 billion hours of OTT are being streamed per month in Southeast Asia. This trend is expected to accelerate with time. Due to the convenience and affordability of OTT media, this trend will persist after the pandemic, as consumers begin to ditch traditional television.

The rise of streaming brings with it more advertising opportunities for businesses, as viewers are willing to watch ads in exchange for free viewing. According to the study by the Trade Desk and Kantar, 89% of Southeast Asian viewers will watch ads in exchange for free streaming content, with viewers in Indonesia and the Philippines being especially tolerant of ads. As digital ads on OTT platforms allow advertisers to target their audiences efficiently, brands are expected to increase their spending on OTT advertising.

As the media consumption trends in the region continue evolving, traditional telco providers are also taking measures to tap into the popularity of OTT. What companies like StarHub and Singtel have done is integrate their linear TV channel offering with OTT streaming services on one platform, so their customers are able to enjoy an omnichannel viewing experience.

Get the latest media & entertainment industry trends

Sports and games go virtual

Despite in-person sports events largely being banned in the region, Asian consumers are still turning to sports as a source of entertainment - through virtual sports and e-gaming events. An example of this is SuperGamerFest 2020 that took place in December last year. The virtual event was presented by PVP Esports and sponsored by Singtel and Philippines’ Globe TelecomThe event consisted of esports championships, awards, and interviews. Here, we also see how the biggest telco providers in Singapore and the Philippines utilized their capabilities to leverage the popularity of e-sports and e-games in the region.

Another trend in the world of sports are virtual marathons - a concept that most of us probably never thought was possible, until COVID-19 happened. Virtual marathons are essentially races where participants compete at their own pace and time and prove that they’ve completed the marathon through a fitness app.

Other than virtual marathons, consumers have been turning to home workouts as a way to destress and stay fit. In New Zealand, it was reported by the Exercise Association of New Zealand that 80% of trainers and exercise facilities had moved online due to the pandemic. This year, one of the leading industry players in New Zealand, Les Mills, announced that they would offer free access to their “On Demand” online group fitness workouts.

Music continues to be a source of comfort

Consumers continue to turn to music as a source of comfort during the pandemic. Despite the absence of physical concerts, musicians and celebrities have found innovative ways to continue engaging their fans and building influence.

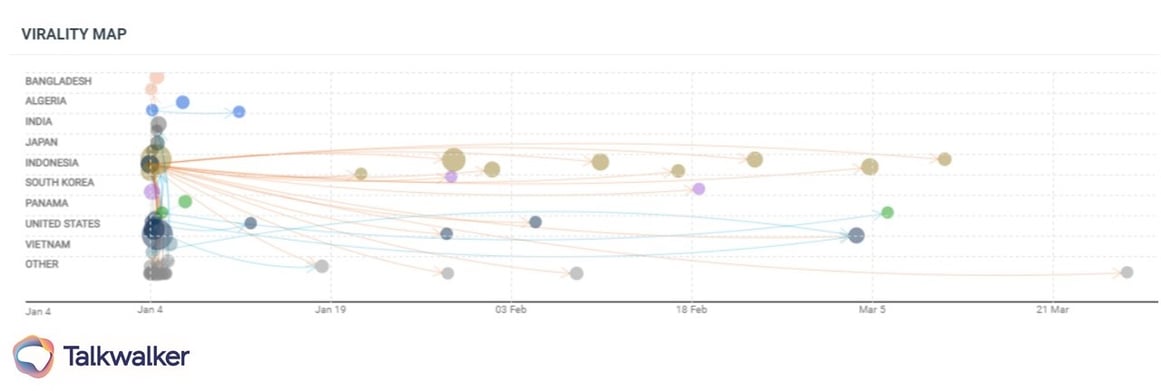

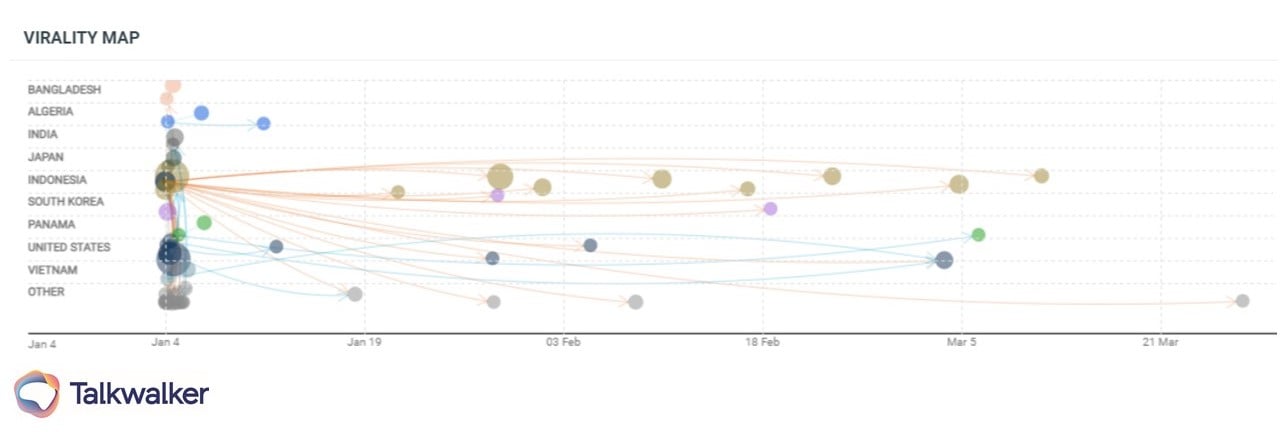

One of the leading celebrities in Asia that continues to dominate is the Korean boyband BTS. In January 2021, BTS was part of a global campaign by Coca-Cola called #TurnUpYourRhythm. The campaign that began in Indonesia and was dubbed #HidupkanSemangatmu, generated nearly 183K engagements on Twitter, and the buzz spread widely across the APAC region.

— Coca-Cola Indonesia (@CocaCola_ID) January 5, 2021

Virality map of the official campaign tweet by Coca-Cola Indonesia

Rise of podcasts

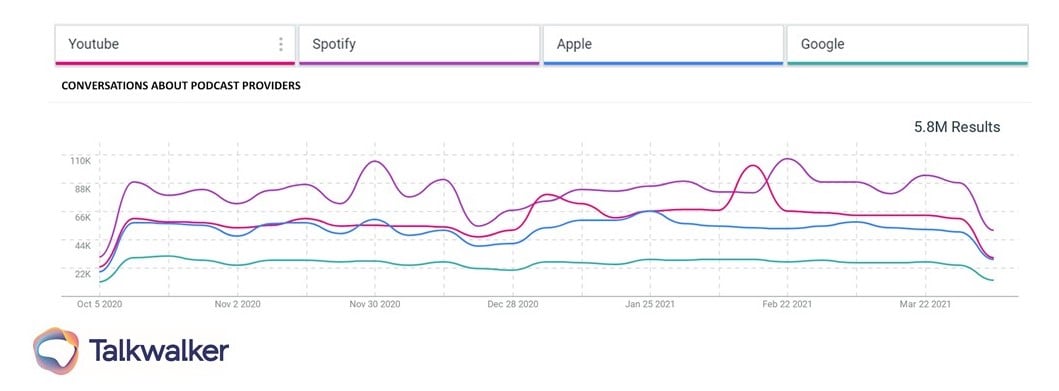

Podcasts are huge today. They allow listeners to dive deep into a topic of interest while multitasking. On top of that, listeners also have playback control and can listen at their own pace. The industry was valued at over $10 billion in 2020 and is expected to double over the next 2 years.

In terms of global share of voice, Spotify has dominated the conversations around podcasts over the last six months

In the Asia Pacific region, India has the 3rd largest podcast listening market in the world, after China and the US, with more than 57 million monthly users. Based on consumer conversations surrounding podcasts in the past 3 months, tech is the most discussed topic, and Apple Podcasts seem to have a greater share of voice than Spotify or YouTube. As consumers continue tuning in to podcasts as a form of entertainment, brands should consider leveraging podcasts to engage their consumers with relevant content.

As seen in the examples above, the media and entertainment industry has evolved greatly. Almost everything is virtual now, and brands in the industry have had to embrace this change and adjust accordingly. While the changes may pose a challenge, they also present new opportunities for media and entertainment brands to innovate and find new ways to stay relevant. For more insights into the media and entertainment industry, check out our latest industry report now!