For example, the marketing strategy of a bank could lead to an increase in opportunities for disabled individuals looking for a microfinance loan. A holistic marketing strategy can help consumers plan for their future and improve their credit score and financial health. The examples are multitude, and the reality is this: marketing strategies that financial services use have the ability to transform lives.

Financial inclusion rates in the Middle East remain relatively low when compared to other markets. According to data from the World Bank, only 27.7% of Egyptians aged 15 and above have a bank account, with that number decreasing in Lebanon to only 20.7%. The marketing strategies of financial service providers play a critical role in increasing financial inclusion rates, especially as new incumbents are diversifying, digitizing, and releasing new innovative products.

There’s a tremendous opportunity for both established financial service providers and fintech companies in the Middle East. This opportunity is further accelerated by regulators’ willingness to create the legal frameworks needed to solidify sustainability and innovation in the financial industry.

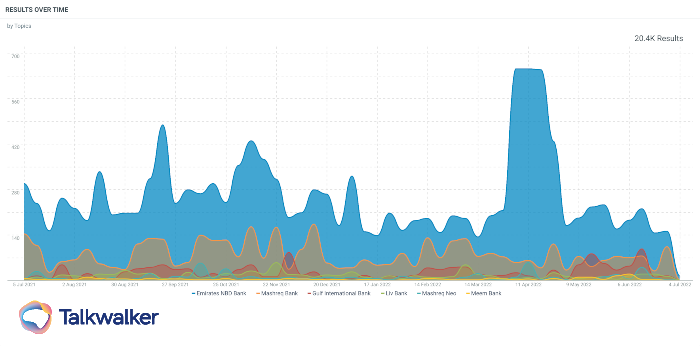

Share of voice of some of MEA’s established banks versus new incumbents over the past year. Established banks have 18.9K results whereas digital banks have 1.4K results.

I’ve previously written about the future of financial services in the Middle East and came to the conclusion that the industry is both resilient and ready for the future. The financial sector in the MENA region has been able to adapt to challenges like COVID, the climate crisis, and the war in Ukraine.

By using capital to create value for consumers, financial service providers can shift their focus to educating and empowering consumers to improve their financial wellbeing.

Marketing strategies for financial service providers are particularly unique because they deal with people’s livelihoods and future plans. Not all financial service providers are created equal, and consumers know those differences.

Banks are entrusted with keeping people’s money safe and helping them grow it. Insurers promise peace of mind to consumers. Investment advisors help consumers navigate complex financial decisions in the pursuit of financial security.

Marketers in financial services must consider the following objectives as their guiding North Star:

- Establish trust with consumers by being direct, honest and clear

- Reflect consistency and reliability at every touch point

- Showcase how the financial service is responsible for making the right decision

Marketing in the financial sector is about more than just having a catchy slogan or logo. It's about helping people improve their lives, without resorting to emotional manipulation or sensationalism.

Why do financial services in the Middle East need their unique marketing strategies?

The Middle East poses a unique challenge for marketers for a number of reasons. First, income levels vary between countries, and even within each country, there’s a huge disparity between high-income earners versus low-income countries. The challenge here would be to create a balance in the type of messaging and tactics to reach the right personas with the relevant financial products.

Second, low financial literacy rates despite advances made in technology and education. Marketers need to make an effort to educate the masses about all the options available in financial services, as well as the risks involved. This educational effort could be done through webinars, videos, simplified blogs, and social media, however, it is important to make knowledge accessible for everyone.

Third, the MENA region is undergoing a digital transformation in its financial sector. Digital banks (STC Pay, Meem, Liv Bank) and fintech startups are building on this opportunity by getting closer to their consumer base through data. On the other hand, traditional banks might be at a disadvantage given their big size and hesitancy to embrace digital channels as quickly.

Marketing strategies for financial services in the Middle East

Depending on the goals and anticipated results, there are several strategies available for marketers in the financial industry. A marketing strategy is closely related to a sales strategy and should not be confused with marketing tactics (which I’ll discuss later).

These are the 4 key marketing strategies for financial service providers, working in cohesion:

- Market penetration strategy: The goal of this marketing strategy is to increase market share by promoting the company's services and seeking opportunities to increase the size of average accounts and reduce customer churn.

- Market development strategy: This marketing strategy can be considered as always-on. It leads to prospect nurturing and conversion down the funnel. A market development strategy is at its core, a growth strategy that its result might not be direct or clear to measure. It’s essentially when a company is attempting to reach target audiences it has not yet reached.

- Product development strategy: This marketing strategy is all about optimizing the experience of customers with the product. This is when product marketers work directly with brand marketers and performance marketers to establish a closed feedback loop with the consumer. Product marketers have the ability to design new financial products that can have a real impact on people's lives. This is done through careful market research, testing, and planning.

- Diversification strategy: A solid diversification strategy in marketing could either be defensive or offensive. Defensive diversification in marketing could be seen as a way to divert the narrative from risk or an ongoing crisis. A defensive diversification strategy allows marketers to spread the risk when there’s no more opportunity for growth. On the other hand, an offensive approach is when marketers conquer new frontiers and are increasing profitability and expansion opportunities.

It is critical to realize that designing and implementing a marketing strategy requires constant adjustments and pivoting. Gone are the days when a marketing strategy is set at the beginning of the year and is expected to perform well. For a marketing strategy to be successful, it must be supported by a strong marketing data, technology, and skills framework.

Romain Mazeries, CEO, MANGOPAY talks about how you can reconnect with your customer, by better listening to social data.

It's important to make decisions quickly and take action in real time. Welcome to the age of real-time marketing.

Explore the power of real-time social media data

Which marketing strategy should Middle East financial service providers adopt?

Before deciding on which marketing strategy to utilize, marketers must know that the Middle East is not a country. It is a rich and diverse part of the world consisting of millions of individuals, each with their own financial literacy and relationship with money. When you speak to everyone, you speak to no one.

Start small, by establishing rapport and getting to know people you will eventually have their trust and generate social equity. Think like a person, people like people who are genuine and resonate with their local culture and values. Only once you truly understand your audience can you conceptualize creative campaign ideas and messages.

Having addressed that, financial marketers need a combination of all 4 aforementioned strategies with granular data on consumer segments. Banks and financial institutions can no longer rely on a one-size-fits-all approach to marketing. Instead, they need to tailor their marketing strategy depending on their target audience, what they want to communicate, and where they want to communicate it.

For example, the marketing strategy for a bank in the United Arab Emirates would be different from that of a fintech startup in Saudi Arabia. The first one would be tailored towards an international audience that has the luxury of choosing between multiple service providers, whereas the startup’s strategy would focus on establishing credibility and trust.

The key thing is that marketing financial services is constantly evolving with the lives of consumers and therefore needs consumer intelligence tools like Talkwalker to provide insights. Social listening is only one part of the puzzle, however, combining social data with first-party data can turn it into rocket fuel for growth.

The Middle East market’s unique traits for marketers in the financial sector

Because of its size and diversity, the Middle East is seen as an attractive market for marketers looking to maximize their brand reach and awareness. The region remains an emerging market by international standards, however, it does have a series of strong points for marketers:

- High budgets and good ROI: According to recent research, the banking sector in the Middle East was the fourth-highest for ad spending in 2021. It is a clear indication that management realizes the importance of digital advertising as a channel to reach audiences and eventually convert them.

- Mobile smartphone adoption: It is predicted that mobile smartphone penetration rates will reach 80% in MENA by 2025. This gives marketers the opportunity to prepare for and embrace a mobile-first approach when it comes to financial marketing.

- Young tech-savvy population: The finance world is going digital, and it's easier for marketers to engage young people in the MENA region because they're tech-savvy. The population in the region is accepting of new innovations such as cryptocurrencies, banking as a service, and other non-traditional financial services.

- High-income jobs in some areas of the Middle East: Many ex-pat professionals in the GCC come to benefit from a tax-free environment where they can accumulate large sums of money in relatively short periods of time.This gives marketers in the finance industry the incentive to target those international expats and offer them services similar to those available back home.

- Clear guidelines and regulations on compliance: Marketing financial services online can be a tricky area to navigate, especially in a market with multiple jurisdictions. On the bright side, regulators like Abu Dhabi Global Market (ADGM) and Dubai International Financial Center (DIFC) offer clear descriptions for all financial products, therefore guiding marketers. For example, when marketing investment-related products, marketers need to clearly highlight that there’s risk of losing money.

Leave the guesswork out of marketing

Marketing tactics for banks and financial service providers in the Middle East

Marketers have a wide range of tools that allow engaging prospective customers at various stages of the purchase process.

The below tactics can be utilized for either brand marketing or performance marketing:

- Blogging: Blogging remains an essential part of any online marketing mix. It highlights that a financial service provider is a pioneer and a thought leader in their sector. For example, marketers could provide insights and data into the current economic environment. Blogging in the finance sector could make it easier for people to understand and use financial services. This is because the terms and conditions of these services are often written using complex language that not everyone can understand.

- Customer data: Having first-party customer data allows marketers to understand where their consumers’ attention is directed. In the financial sector, marketers would have a granular understanding of their consumers’ income levels, spending behavior, emotional spending triggers, and so much more.

- Social media marketing: Social media helps both B2B and B2C marketers reach new audiences, strengthen relationships, create trust, and foster a sense of community. Even more, it creates a valuable source of data for all business arms especially as consumers are increasingly relying on social media to request information and stay informed.

- Customer service: With increased adoption of artificial intelligence and robo advisors in the finance industry, marketers could leverage these interactions to understand the true pain points of consumers. Customer service’s true business value not only lies in resolving customer issues, but also in engaging customers at a moment of readiness. If consumers receive stellar customer service, they are more likely to refer the financial service provider to their network. Word of mouth remains a powerful driver of brand loyalty.

- Video content: Video marketing is a powerful tool that allows marketers to reach vast audiences while maximizing brand recall. Video content is versatile and customizable by language, length, and format.

- Digital signage and OOH advertising: Digital signage and OOH advertising can reach consumers at multiple touchpoints, such as airports, sports stadiums, and bus stations. This can be helpful for marketing financial services, which can have a diverse impact on consumers.

- Non-traditional rewards programs: By analyzing consumer data, financial service providers can realize upselling opportunities by offering ‘non-traditional’ incentives, especially when it comes to credit cards.

- Strategic partnerships: Marketers in the financial services sector can bolster their position as market leaders by partnering with other companies that share similar values and goals.

- Community initiatives: Whether it’s a marathon, a charity event, or a tree-planting activity, community initiatives leave a positive impression on consumers.

- Outbound marketing activities: When it comes to large enterprises, sometimes the best way to reach those individuals is to simply pick up the phone and introduce yourself and your business. Many people in the Middle East consider their financial wellbeing to be a private matter and would rather not discuss it in public.

Distribution of languages used by consumers on social media when talking about banks in Saudi Arabia during the past 30 days. Arabic dominates with 94.5% of the conversations using the Arabic term for ‘bank’

Use data to build long-lasting customer relationships

Client spotlight: How Abu Dhabi Islamic Bank uses Talkwalker

Talkwalker and Abu Dhabi Islamic Bank (ADIB) recently published a case study highlighting the power of consumer intelligence in maintaining a positive consumer experience.

The mobile app of ADIB was at 4.8 stars review ranking, the UAE’s top finance mobile app, however was starting to shift downwards due to a series of negative reviews. After using Talkwalker, the team was able to bring the score up and regain its position.

Ultimately, ADIB's team succeeded in improving customer experience, increasing brand loyalty by 12%, and improving positive sentiment by 40%. As a result, the mobile app regained its number one position in its category in the UAE.

Conclusion

Marketing professionals in the financial services industry are aware of the changes in consumer expectations and have the tools necessary to deliver tangible results. Creativity and innovation are important for businesses to be successful, but data is what will really help them to grow and improve.

Talkwalker makes consumer intelligence easy for financial service marketing professionals. From a single dashboard, you can listen to your customers, explore insights, stay ahead of the curve, mitigate risk, and stay compliant.