Table of contents

1. What is the metaverse?

2. How can consumers access the metaverse?

3. Metaverse opportunities for brands

4. Metaverse campaigns by brands: hits and misses

5. Building consumer communities in the metaverse

6. Which consumers are talking about the metaverse?

7. What consumers think, feel, and do in relation to the metaverse

8. How should brands think about the metaverse?

9. The one key takeaway for brands and marketers - Use your brand DNA as an anchor

1. What is the metaverse?

A sci-fi concept

The phrase “metaverse” was first invented and used in Neal Stephenson's 1992 Sci-fi novel Snow Crash. The word "metaverse" is a combination of the English word "universe" with the Greek word "meta," which means "after" or "beyond." In the novel, characters use virtual reality goggles to move through a three-dimensional cityscape constructed entirely with computer code, while experiencing a full spectrum of immersive sensory experiences.

An emerging industry

With a compound annual growth rate of 47.2%, the worldwide metaverse market is expected to increase from USD 61.8 billion in 2022 to USD 426.9 billion in 2027. It is anticipated to grow at the fastest rate in Asia Pacific, with an average annual growth rate of 49.6% over the next five years.

A new consumer connection

While practitioners in the space currently have varying definitions of the metaverse, we agree in general that the metaverse needs to have three ingredients to be considered as a metaverse: It needs to be immersive, social and interactive.

2. How can consumers access the metaverse?

It is a popular myth that we need a pair of VR headsets to access the metaverse. This is not necessarily the case. Currently, end users can access the metaverse via hardware gadgets like AR goggles, VR headsets, haptic suits, and even through their smartphones.

While it currently is free-of-charge for most end-users to access most metaverses, whether consumers invest that time and energy is another matter. At this point in time, entering the metaverse is considered a high friction activity for most, with problems ranging from lacking the know-how (e.g.operating VR headsets), experiencing side effects (e.g. suffering from migraines and eye aches due to prolonged usage), and not being able to afford some of the gadgets. Unless and until user experience improves in these aspects, mass adoption of the metaverse could be difficult.

3. Metaverse opportunities for brands

Why then should brands consider entering the metaverse? Let's take a deeper look into three opportunities for brands...

Opportunity #1: Additional sources of revenue

The metaverse could provide additional streams of revenue for brands.

There are many ways of creating additional sources of revenue for brands. Brands on the metaverse can sell their intellectual property as NFTs, and build Web 3.0 brand equity and collectibles through brand storytelling. Some brands may even sell NFT property - a programmable plot of land that users can explore using their 3D avatars. Brands could also create entire gaming worlds on the open metaverse and leverage innovative decentralized finance tools to monetize these experiences.

Opportunity #2: Zero physical inventory, higher profits

Especially for the luxury and retail industries, physical inventory planning and management can be a major cost center. When mismanaged, this may even cause the company to incur heavy losses.

Through NFTs as a vehicle in the open metaverse however, brands can do away with physical inventory that is subject to wear and tear, and depreciation. The cost of producing an additional NFT as a product is almost negligible considering one could use generative AI to create the artwork; yet revenue from the sale of the NFT could be similar to that of physical products.

Opportunity #3: A brand new way of storytelling and enhancing of consumer experiences

The secret to keeping the interest of consumers is to curate and design more delightful retail experiences, that increase brand value and brand affinity.

Increasingly, phygital is becoming a bigger and bigger phenomenon in retail. Utilizing virtual try-ons and AR-enabled commerce makes it simpler for customers and increases their confidence in their buying decisions. Take for example how Indian e-commerce giant Flipkart integrated Snap’s Camera Kit to its app last year, enabling customers to try-on items and even fit virtual furniture in their living rooms. This launch made it in time for the festive season, and helped Indian consumers make more informed purchases.

Brands could also make use of other emerging technologies associated with the metaverse to create ever more immersive experiences for their users. With the use of meta-humans, augmented reality, virtual reality, and even haptic suits, for example, brand stories can eventually become personified, seen and even felt.The increased deployment of 5G in the Asia Pacific region is likely to speed up networks to such an extent that marketers will be able to build dynamic digital worlds that can change in real time. Truly, as marketers, we are only limited by our imaginations!

4. Metaverse campaigns by brands: Hits and misses

Immersive storytelling enables viewers to move from "observation" to "experience," allowing consumers to virtually "put themselves in another's shoes" and feel a sense of belonging to something that is larger than themselves.

It also opens up an opportunity for brand storytellers to develop closer relationships with customers. Immersive and shared experiences can enhance the relationship between the customer and the brand, especially in this age when customers are more interested than ever in learning about the purpose of brands and how those values are aligned with their own.

Let’s take a look at a few hits and misses when it comes to brand campaigns in the metaverse.

Hit: SK-II City

SK-II City is an example of a bespoke virtual world created by a luxury brand. Customers of luxury brands like SK-II presently interact with them on their social media pages and websites. As we move towards Web 3.0, such virtual worlds will serve as the brand’s future business cards.

In particular, the SK-II City is a hit because the brand also features Six VS Series movies available for viewing in the virtual city, simulating a trip to a public cinema. The animated movie series is focused on the struggles that six Olympic athletes faced in real life and how they overcame them. The movies look at various aspects of societal pressure, namely: Trolls. Pressure. Image Obsession. Rules. Limitations. Machine-Like Mindsets. These themes encourage engagement with SK-II loyal customers within their virtual city.

SK-II has also created Yumi, an AI-driven virtual human ambassador embedded within the virtual city that customers can communicate with 24 hours a day. However, it is interesting to note that users cannot presently engage with one another online in SK-II City, a functionality that SK-II might be working on in future.

Hit: Gucci x Roblox

For luxury brands that do not want to take on the higher risk of building their own branded worlds from scratch, they can always take a leaf out of the Gucci playbook and build their world with Roblox.

Gucci started their foray into virtual immersive experiences via Gucci Garden, a two-week event the brand conducted on Roblox, last year. Users were urged to interact with the floral elements through Gucci's digital gardens and avatar accessories-like digital items, the latter of which turned out to be more profitable than real-world commodities. For example, a Gucci Dionysus bag with bee embroidery that was only usable on Roblox during the event went for 350,000 Robux, or around $4,115. Currently, the digital item is not interoperable across other metaverses.

Based on the positive feedback and data from Gucci Garden, Gucci then created Gucci Town, a permanent location hosted on Roblox, marking the brand's formal entrance into the metaverse. The concept, according to the luxury brand, is a "dynamic location" where users can learn more about Gucci’s vision, express their individuality through virtual apparel, and meet others who share their interests.

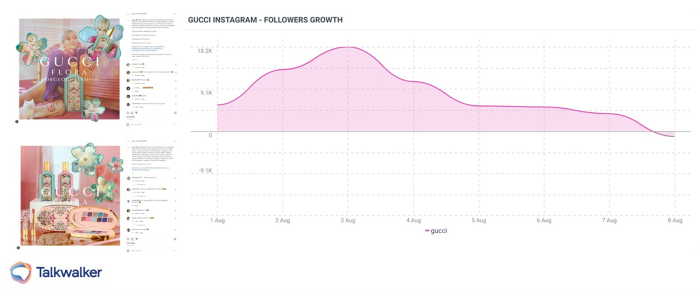

Channel Analytics of Gucci’s Instagram profile revealed that Gucci had an uptick in followers after their two Gucci Flora posts. The Flora team took over Gucci Town in August 2022 and featured Miley Cyrus as the brand’s first-ever avatar guest.

This foray into the metaverse was a hit because it tapped into the younger and new community of Gucci fans, helping the brand reach another level of engagement.

Miss: Pixelmon

![]()

Because many brands are currently experimenting with the metaverse, it is inevitable that sometimes expectations are not managed well. One good example is Pixelmon, a metaverse project which raised $70 million and failed user expectations during its NFT reveal.

Not only did the horrendous artwork draw a lot of backlash from Pixelmon’s community of retail investors and buyers, the bad news was exacerbated when the core team announced that they were looking to spend another $2 million to fix the artwork and animation.

5. Building consumer communities in the metaverse

Given the community-based nature of brand audiences today, social listening and consumer intelligence provides brands the ability to track meaningful brand, industry and user conversations. This is enabling marketers to make data-driven recommendations on who to partner with, which channels to use in their outreach, and how best to nurture brand-consumer connections.

The same applies to metaverse activations…

- Which metaverse(s) should brands be thinking about?

- Where are metaverse discussions happening?

- What are consumers’ expectations of the brand experience in a metaverse?

We provide a snapshot of our preliminary findings via the Talkwalker platform below.

6. Which consumers are talking about the metaverse

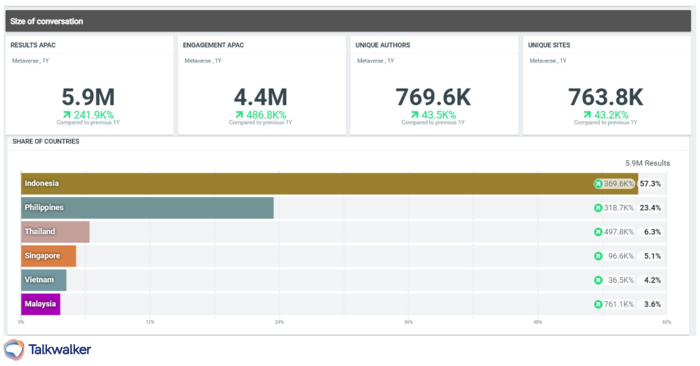

Based on Talkwalker’s social data, there have been at least 5.9M conversations on the metaverse over the past year in Southeast Asia – and this is based on a 25% sample size alone.

The hotspots for ‘metaverse’ mentions in Southeast Asia are Indonesia, Philippines, and Thailand. When it comes to tracking the number of engagements on these posts, however, Singapore overtakes Thailand to make the top three countries that are ranked.

Conversation hotspots for all things ‘metaverse’: Indonesia, Philippines, Thailand, Singapore.

These data points give us a peek into the distribution of consumer interest in the ‘metaverse’ topic across a diverse and populous region such as Southeast Asia. And they provide a brand with some grounds to deliberate their allocation of resources, in order to design activations with greater local appeal and impact.

7. What consumers think, feel, and do in relation to the metaverse

Another dimension of ‘metaverse’ trend research would be to look into key themes in consumer conversations around the metaverse.Talkwalker data shows that ‘metaverse’-related conversations are broadly driven by interest in Metaverse Gaming Projects (34.3%), NFT-related news and giveaways ( 24.3%), as well as discussions on cryptocurrencies (17.2%).

Key conversation themes based on metaverse conversations in Southeast Asia from the period 21 September 2021 - 21 September 2022.

Keeping a real-time pulse of these conversations is going to be vital in helping brands to understand where consumers are directing their focus and energies, and which incentives (for example NFT ownership, in-game credits, etc.) are keeping them engaged.

8. How should brands think about the metaverse

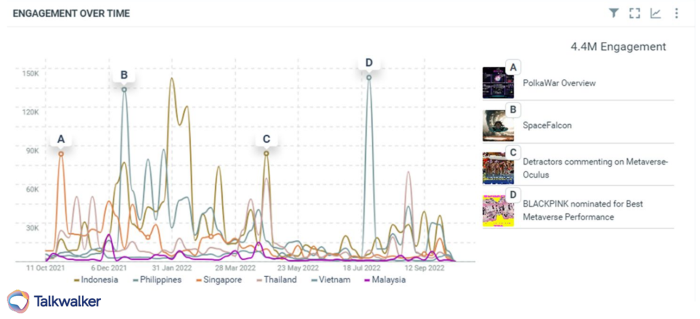

Finally, it’s important to note that not all metaverse activations are equally received. Even within each concept and topic cluster, consumer sentiment tends to vary. Below is a graph showing some of the peak mentions over the past year, covering metaverse and metaverse gaming projects, which produced a range of consumer sentiment:

- Neutral: PolkaWar and SpaceFalcon are Web 3.0 games that debuted at points A & B.

- Positive: The electric collaboration between two large fan bases resulted in massive support backing the nomination of the PUGB Mobile x BlackPink in-game metaverse concert at the MTV Music Awards.

- Negative: Government of Indonesia metaverse initiatives have been on the receiving end of criticism in recent times, with many social media users desiring more practical investments instead.

Peaks and troughs - Talkwalker’s Peak Detection feature helps plot data points over a specific time frame, this time focusing on the metaverse conversation in SEA countries.

AI-enabled sentiment analysis can come in especially handy, for brands that are looking for a sentiment score, and a real-time view of their campaigns and activations. Even more crucial is the social listening research that goes into designing metaverse campaigns and initiatives, in order to offer products and experiences that can truly help bridge the brand-consumer gap.

9. The one key takeaway for brands and marketers - Use your brand DNA as an anchor

It is clear that most brands are currently experimenting with the metaverse, which gives rise to the popular conception that it could just be all hype, rather than a sustainable trends.

Technological cycles of change are getting shorter and shorter. As marketers, we have to learn how to make better choices with faster and less complete, highly asymmetrical information. This could mean getting used to dynamic states and pivoting along the way, rather than expecting things to go as planned.

Overall, with the huge capital flow going into the space, there is also a high probability that the metaverse will become a self-fulfilling prophecy. Therefore, the right question that a brand should be asking could be how to “be okay with” risk while still boldly experimenting in the space. Brands will ironically have to go back to basics, to tap into their DNA and their existing brand-consumer relationships. This will serve as an anchor as they make their forays into the metaverse.