Start planning your digital marketing strategy

Fintech in the UK

Firstly, let’s look at the evolution of the fintech sector in the UK to give the success of Monzo some context. Fintech, the popular term for ‘financial technology’, has been a rapidly growing sector in the UK over the last decade or more. 37 of the “Fintech 50” firms are headquartered in London, and the sector contributes more than £11bn to the UK’s economy. The success of the sector is largely down to a few key factors:

-

A supportive regulatory environment for innovation in financial services

-

The appetite for innovation from UK consumers

-

Increased investment in the sector.

Currently, around 12 million people in Britain have opened an account with a digital-only bank and nearly two thirds of Brits use contactless cards compared to 3% in the US. With this in mind, it’s no surprise that online-only banks have risen in popularity among UK consumers. This trend doesn’t just stop with personal banking. More and more SMEs use online banking for their businesses.

The demand for online banking innovation is so strong that in 2019, the big 4 banks in the UK (Barclays, HSBC, Lloyds Banking Group and NatWest Group) spent £10bn on digital transformation. But there is something about online-only banks, such as Monzo, that has managed to capture the interest, and trust, of British consumers.

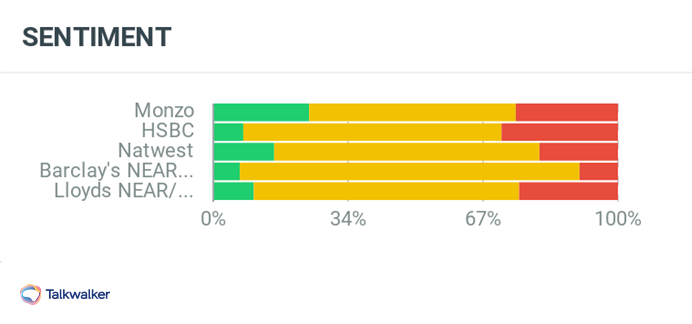

Sentiment towards Monzo and UK big 4 banks over the past three months.

Download your free digital marketing strategy e-book

How is Monzo changing traditional banking?

Monzo originally started life as a prepaid card in 2015 under the name Mondo. They were forced to change their name to Monzo in 2016 after a legal challenge to the “Mondo” trademark. It doesn’t seem to have affected their success in any way though. In February 2016, they set the record for “quickest crowd-funding campaign in history” when they raised £1m in just 96 seconds via Crowdcube.

Since then, the online bank has continued to grow, becoming a fully authorised bank in the UK, and reaching one million customers by October 2018. In the same year, they also gained unicorn status, receiving a valuation of over £1bn. Interestingly, it’s only in the last year or so that Monzo has implemented a more traditional marketing strategy, but I’ll delve into that later.

Thanks to features such as free ATM withdrawals abroad, connecting to Amazon Alexa and teaming up with TransferWise to offer international money transfers, Monzo has been able to offer its customers something that traditional banks had never provided before and thus tap into a whole new market. Traditional banks are trying to adapt to keep up, but they sometimes fall short...

Hey @AskHalifaxBank

It's great to see your updated brand identity, but it looks like you forgot to update couple of things.

The card in the photo still displays the @monzo BIN (5355 22) and the name of one of our staff members... pic.twitter.com/Ykqvz3mPZU

— Tom Blomfield (@t_blom) April 12, 2019

Monzo isn’t the only online bank challenging the status quo. Starling (the first challenger bank in the UK, and where CEO, Tom Blomfield and his other co-founders met) Revolut and N26 are the main competitors to Monzo in the UK. However, when we look at which of these is being talked about and engaged with more, Monzo is streaks ahead of the field.

Mentions of and engagement with Monzo, Starling, Revolut and N26 over the past three months.

When it comes to positive sentiment towards the brand, Monzo is again ahead of its competitors.

Sentiment towards Monzo, Starling, Revolut and N26 over the past three months.

To understand why this might be, let’s take a closer look at Monzo’s financial industry marketing strategy.

Get your free digital marketing e-book

What sets Monzo’s marketing strategy apart?

Focus on community

Community building has been a crucial part of Monzo’s marketing strategy from the beginning. The initial crowdfunding campaign is a great example of this. According to VP of marketing, Tristan Thomas, crowdfunding is all about customer engagement - letting customers be part of it.

At the beginning of its life, and to an extent still today, Monzo was very reliant on word of mouth marketing. Until recently, around 80% of its growth efforts were focused on word of mouth, using community meet-ups and hackathons to spread the word.

You can see this in their community forum. Consumers and employees both contribute to this, and it’s done in a way that’s different to traditional ‘help’ forums, which can often feel sterile and corporate. Instead, all employees come across as invested in the brand but mainly wanting to help customers. It’s also a place where customers can help generate new product ideas, by sharing feedback with the brand. This more personal connection with customers, and enabling customers to get involved in the brand development, helps to generate love towards Monzo. And we all know that brand love leads to long term business success by creating customer loyalty and advocacy.

This focus on community building has paid off. Not only has the bank seen rapid growth, but they also topped YouGov’s Brand Advocacy Ranking for 2019 by quite a margin.

Start planning your digital marketing strategy

Transparency with customers

It’s not unusual for crises to happen in companies, but it’s really how you deal with a PR crisis that determines the impact on the brand. Monzo has always taken a transparent approach to communication with their customers, regardless of whether the news is good or bad. Most notably, in 2019, Monzo alerted around 500,000 of their customers to a flaw that allowed their software engineers to access some customers’ PIN numbers, urging them all to change them. Whilst no private customer information was released or exposed, Monzo decided that honesty and transparency was the best approach to prevent this issue escalating into a crisis.

No information's been exposed outside Monzo, and this data hasn’t been used for fraud.

You should update your app, and we're emailing everyone that’s been affected to let them know they should change their PIN as a precaution.

Read our full update https://t.co/cKf5p5I87w

— Monzo (@monzo) August 5, 2019

As you can see from the graph below, whilst there was some initial negative reaction to the news, sentiment towards Monzo quickly picked up again and has remained generally positive since then.

Talkwalker’s Quick Search shows net sentiment towards Monzo over the past 13 months

Refine your digital marketing strategy

Branding and image

One thing that makes Monzo stand out from other brands is their neon, coral bank card. The flash of colour in a wallet definitely grabs people’s attention, and this was the intention. According to the head of design, Hugo Cornejo, they wanted something that people might ask about if it was handed over in a restaurant. And whether it was a happy accident, or truly inspirational, it also tapped into one of the big fashion trends of the time: neon.

Their card has arguably been one of their biggest marketing assets, helping to feed into their word of mouth marketing strategy. Monzo have continued to focus on the look of their cards, introducing a new holographic card in 2020, exclusively for Monzo Plus account holders, that completely changes the traditional look of the card. This bold brand statement continues to help them distinguish themselves from their more traditional banking competitors. And given these stylish-looking bank cards become hot property, it’s a great strategy to get customers to upgrade from free access, to fee-based accounts.

Thanks to everyone who's signed up for Monzo Plus since we launched last month.

We just passed 50k accounts and couldn't be more pleased! pic.twitter.com/N9kvD3TZOE

— Monzo (@monzo) August 19, 2020

Not one to rest on their laurels, Monzo is already planning their next brand move, with talks of a new account with a metal card.

Get your free digital marketing e-book

Tone of voice

Similar to their branding, another key area of Monzo’s marketing strategy is their tone of voice, and how they communicate with customers. It’s so important to them that they even have a page dedicated to it on their website. I haven’t seen many banks do that. Having a clear tone of voice is crucial to Monzo as they are an online-only bank, with no physical branches which means they have very few opportunities to meet with customers face-to-face. All the information a customer needs has to be clear and accessible online.

In general, the language around money that traditional banks use can be overwhelming and confusing to many people, creating a barrier between them and their bank. It’s hard to trust someone with your hard-earned money when you don’t fully understand what they’re going to do with it. According to a 2017 YouGov survey, only 55% of people in the UK trust their banks.

Monzo has made an effort to be transparent (that word again) with their customers by using language that’s easy to understand. Particularly when it comes to areas of finance where traditional banks would rely on overly technical language. Rather than using formal language, like ‘assistance’ or ‘commence’, they use language more commonly spoken in everyday conversations, such as ‘help’ or ‘start’. They actively try and make their writing sound more natural and approachable to consumers, which helps build trust.

How to replicate Monzo’s marketing strategy for your brand

Whilst Monzo aren’t the only successful challenger bank on the UK market, they’ve clearly been successful in growing their brand in a short period of time. Here are some key takeaways from Monzo’s marketing strategy that could be applied to any brand:

-

Be customer centric. By putting the customer at the heart of your marketing strategy and shaping your business around them, you help to create trust. Whether it’s understanding their pain points or talking to them in a way that they recognise and feel comfortable with, this builds a direct connection that leads to loyalty.

-

Find brand advocates. Following on from the first point, if you’re able to build trust with your customers and create loyalty, they will be the best advocates. In addition, you can also look to work with influencers to get that extra boost. However, make sure they’re truly aligned with your brand message to create a more natural connection with audiences.

-

Be transparent. Things can go wrong at any time. But your customers are more likely to be forgiving if you’re open and honest with them from the start and show how you’re taking steps to fix a situation.

-

Focus on the details. It’s often the small things that don’t cost a lot of money that make the difference, like the way you talk to your customers or the colour you choose for a product. These are the things that people remember and keep them coming back.