That’s because the global pandemic has changed everything, not least of all the holiday shopping season and Black Friday. The customer experience in physical stores has been shattered and with consumers opting to shop online, the e-commerce market in the United States is a place few brands can afford to ignore.

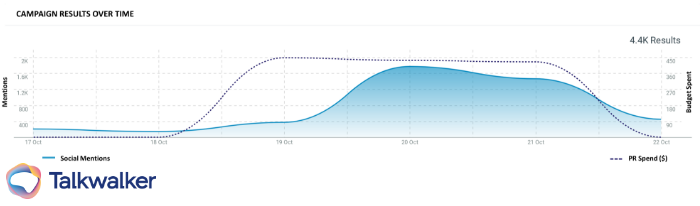

This graph shows how PR spend can pay off in the form of social mentions.

The US report looks at major brands taking on this channel for themselves, including: the new launches of video game consoles from Sony and Microsoft, the growing at-home snack space where PepsiCo is taking a more active role, how Bed Bath and Beyond won new sales from TikTok scrolling audiences, and of course reactions from the biggest retailers like Amazon, Walmart and, Target.

Even in a pandemic, nothing sold online is limited to local, and the internet allows for frictionless commerce across borders. The US report also includes local insights from IKEA in Mexico and the British supermarket Morrisons. It also includes insights into the burgeoning social commerce trend and “buy now pay later” (BNPL) models.

This report comes with free shipping

What's changed in the pandemic is what will stick around

Perhaps it should come as no surprise - with the year 2020 has been - but one new reality all e-tailers are dealing with now is the heavy-footed arrival of traditional retailers.

Brands, seemingly overnight, have retooled and reinvented their online stores - creating direct sales channels for their products. No longer encumbered by waiting for the Amazons and eBays of the world, brands are using their market size to deliver their products right to consumers.

In the era of social distancing, brands are pushing their intermediaries more than 6 feet away. As consumers embrace the new ship-everything lifestyle, it remains to be seen if there’s a place for the e-commerce set, the traditional interlocutors of the industry, to bounce back.

Another key reality is that if you blink you might miss it: this is happening fast!

It can feel like it’s overnight. E-commerce was once the sleepy domain of the internet-obsessed. Think back on the retail trends of just a few years past - the era of the flagship store, the experiential shopping treatment, the limited time only pop-up selling limited edition merchandise - that was where brands were focusing efforts.

Abandoned carts be gone! Get my report

Those buzzy retail trends may come back in the second half of 2021, but for now everyone is shopping in (and for!) sweatpants. Convenience is king, and free shipping is queen.

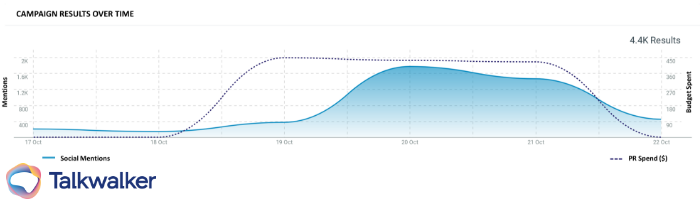

Social mentions don’t mean much if they’re not translating to sales. Here again, we see a correlation between mentions and sales.

Store-offered financing

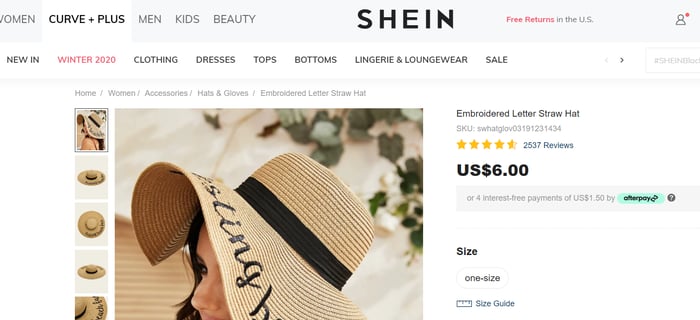

What’s more American than buying the biggest, the newest, the loudest possible product you can? Financing it, of course! The “Buy now, pay later” (BNPL) model is here to stay.

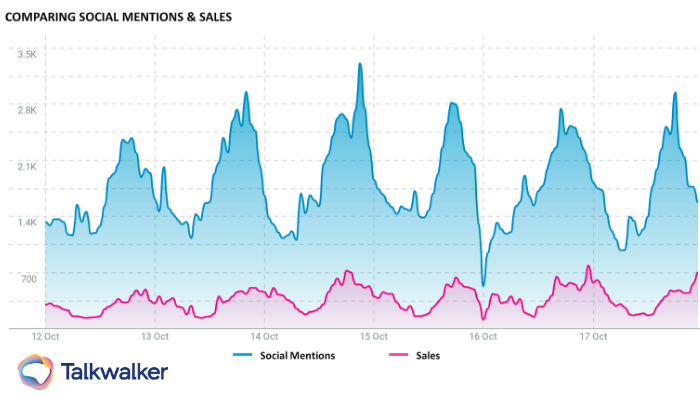

The rise of financing options available on websites follows in the same vein as department store financing, or even the automobile industry. But now customers are facing an array of financing choices as they checkout. Klarna, Affirm, Afterpay and more are all competing for the opportunity to break up those payments into easy monthly installments.

Even small purchases can be split into smaller purchases

Talkwalker’s research in the e-commerce report shows that in the BNPL industry, almost half of the discussion is made up by millennials. Gen Z accounts for over a quarter of the discussion too.

This growing finance channel will continue to eat into market share for credit cards. Partially in response to this, we’re seeing unprecedented offers from major card companies to be top of the wallet for holiday shopping this season.

Other findings include a rise in mentions of the “buy now, pay later” model, and sentiment drivers reveal that ease of splitting payments is an important consideration.

Look for major retailers to continue to offer more ways to finance purchases, and further incentivize certain spending methods through more exclusive partnerships with financial institutions.

Social Commerce

A new way to shop is quickly becoming the most talked about new method for driving sales as people stay home. Social commerce is already a popular trend in China, and Talkwalker has also identified it as a social media trend in 2021.

Capitalize on FOMO and exclusivity with social commerce.

This method of going live on social media to sell products in the most limited-of-times way. It gives retailers an opportunity to combine exclusivity and product recommendations from influential sources, while recreating the social shopping experience.

It’s a growing trend that will continue to drive growth for e-commerce retailers through share-of-mouth referrals long after the Story, and opportunity to buy the product, has disappeared.

E-commerce is moving quick

As the biggest brands jump into the channel, driven by a year that’s been anything but normal, expect the changes happening in the industry to continue at a breakneck pace. Brands that continue to deliver what consumers demand, brands that twist and pivot to meet those shifting demands, and brands that are keeping close tabs on these moving trends will continue to dominate the e-commerce industry.

Check out the Talkwalker e-commerce industry report to help your brand keep pace with the biggest e-commerce channels.