Discover the metrics that matter for success

Customer acquisition is expensive. It requires a well-planned customer journey, converting nurtured prospects into paying clients. It requires marketing plans, sales teams, advertising strategies, time, and money.

But there’s a more cost-effective way to make money. Customer retention - keeping your current clients loyal, encouraging them to buy more, getting them to promote your brand to others. According to the Harvard Business Review, acquiring new customers for your business is anywhere from 5 to 25 times more costly than retaining an existing one. And by increasing your customer retention rate by 5% you can increase profits by 25% to 95%.

That’s something every brand can appreciate. But how exactly do you get that 5%?

How do you keep customers?

Before you consider keeping customers, you should first calculate your customer retention rate. How can you measure improvement if you don’t know where you stand?

There are several data streams you could use to track this:

-

Customer number levels. This is a formulaic method from Jeff Haden that looks at the changes in the number of customers you have:

Retention Rate = ((CE-CN)/CS) X 100

(CE = number of customers at end of period. CN = number of new customers acquired during period. CS = number of customers at start of period)

This gives you a number to monitor, but little reasoning behind the data. Why are customers leaving you? There’s no way to tell here.

-

Loyalty program data. This can give you more insight into your customer buying habits. Helps you define what is a loyal customer, and what’s stopping them from being one. How frequently do people buy from you, and what would you prefer that frequency to be?

Loyalty programs are also fantastic engagement tools, especially when done in technologically engaging ways. 95% of loyalty program members will engage with the brand’s program through new and emerging technologies.

-

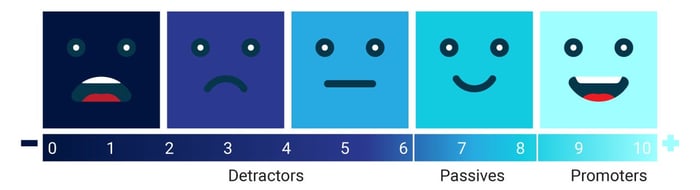

Net promoter score®. A specific customer survey that measures customer loyalty.

NPS helps identify whether people are likely to compliment or critique your brand.

-

Detailed customer surveys. In-depth questions targeted towards your consumer base can help you identify the reasons people leave, and therefore the likelihood of them switching to a competitor.

-

Other customer data. Social media or customer service data could also be useful to help build a profile of your customers most likely to leave you, and identify how many are likely to.

Ideally, you don’t want to monitor all this data in isolation. By combining it into a single source of truth, you can see how these different levels correlate. Creating a more informed idea of your brand’s retention rate.

Analyzing your customer retention data

The real skill behind customer retention is improving customer satisfaction. Making sure customers are happy with your product/service/brand.

It would be great if you could rely on direct customer feedback to understand your satisfaction levels. But there’s a major issue here. Even though 50% of your customer base will churn naturally over 5 years, only 4% of unhappy customers will actually bother to complain.

The rest will just leave.

That means 96% of your unhappy customers won’t directly highlight the fact that they’re unhappy. It’s just easier for them to take their business elsewhere.

That means you need to work with indirect feedback. Either by hunting down feedback through customer surveys, or gathering social analytics online.

Social data

65% of a company’s business comes from existing customers. And even if they’re not talking to you directly, they will be discussing your brand indirectly.

Whether that’s in blogs, on social channels, through news stories, across forums, you will be top of mind when conversations come up relating to your brand/product/industry.

What you need to do is see how you’re discussed in these conversations. These independent discussions are essential for identifying issues that you could be tackling to improve that all-important retention rate. Look for:

-

Important topics. What are the pain-points people identify in these conversations? Are there issues that are coming up again and again? Or, is the consumer displaying signs of switching to a competitor?

Highlighting some of the main crisis topics impacting the airline industry. A deeper dive would identify the issues that consumers are complaining about the most.

-

Sentiment. Especially when relating to customer service levels. 93% of consumers are more likely to make repeat purchases at companies with excellent customer service. Customer service matters - if you can identify an issue, resolve it ASAP.

-

Competitor analysis. Look at what people are saying about your competitors online. You may not have a major issue yourself, but clever marketing from a competing brand could still be tempting people away. Look to see how rival brands are discussed in public conversations, and see if there’s any particular messaging you need to counteract.

Review data

After a negative customer service experience, 70% of respondents say they will advise their friends and colleagues against buying the product or service in question. This is why review data is so important when focusing on client retention.

For those people not providing you with direct feedback, they’re much more likely to provide indirect feedback via review sites.

For monitoring, there are two types of reviews. Ones built into the retail environment - like Amazon or Google Play store. And ones hosted on independent sites, specifically designed to provide impartial product reviews - Glassdoor, Yelp, TripAdvisor. Ideally, you should measure both.

The good thing about reviews is that they’re usually very polarized - either very good, or very bad. Analyze each section separately.

-

Good reviews. Should help identify positive customer engagements - what is working for client retention. Find the elements that appear in these reviews constantly, and repeat them as necessary. Try and engage with positive reviews as they’re likely to promote your brand in other places, especially if encouraged.

-

Bad reviews. These will highlight your pain points - the repeated issues that are driving people away. Find the biggest problems and ensure you tackle them effectively. If done well, engaging with negative reviews could actually help you retain clients. A well-handled complaint makes customers 67% more likely to return to a company or brand.

This review demonstrates something that could be a pain point - the queue - isn’t as big an issue.

Internal customer data

This data can be made up of customer success data, chat data, sales calls, marketing influencer conversations. Pretty much anything that can include conversations about your brand.

You should always look for the opportunity to gain customer feedback - and proactively use that information.

As before, try not to silo this data. Look to integrate all of the sources, plus social and reviews, into one place to enable easier and more consistent analysis. Social can help you identify the reasoning behind a low NPS score. Bad reviews could be causing the drop in customer number levels.

Only by looking at all available data, can you find the gaps in your knowledge, and complete your customer picture.

Data - Your best customer retention strategy

As you can see, focusing on customer retention programs can be a valuable asset for any company. A cost-effective way to boost revenue from existing clients, with less focus (and budget) spent on attaining new ones.

For all the metrics you should monitor as a brand, for customer retention, consumer analysis, and brand monitoring, download our metrics that matter eBook below.