Setting the CPG scene

Imagine this: your brand sells delectable chocolate-dipped pretzels, but things have been less than smooth recently. Consumer demand is skyrocketing, and throw in labor shortages, a lack of materials, and congested transportation points, and you have a very high risk for supply chain disruption. Disappointed customers and lost sales may result in a business impact that not even the best sweet-and-savory snack can rectify.

Before diving into the pain points of the supply chain and identifying possible solutions, let’s get some more context. What food industry trends are affecting supply chains? What are consumer conversations focused on for the future of CPG?

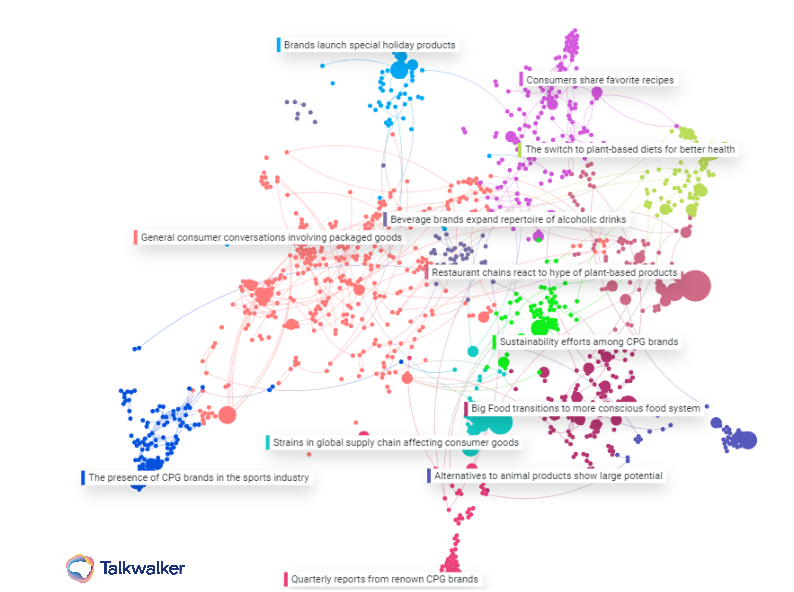

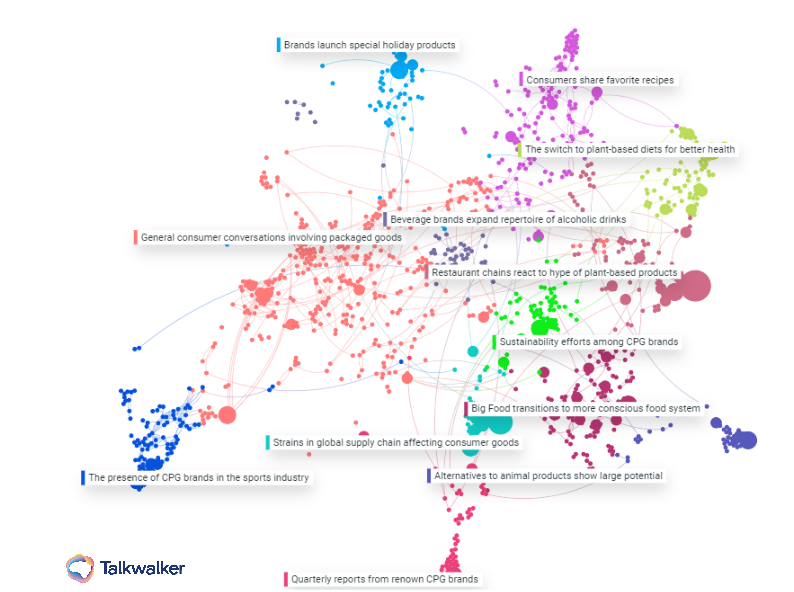

Conversation Cluster surrounding CPG conversations online.

The overarching theme for CPG food & beverage brands will be the transition into a more conscious way of producing food, a change that is being led by two factors:

- Consumers increased involvement in topics like sustainability, social impact, and accountability for brands across industries.

- The inequalities regarding access to food, and problems of food waste and food security, all of which have only worsened due to the global COVID-19 crisis.

Changing consumer behavior directly impacts supply chains and how CPG companies operate. Brands need to respond by changing the way food is sourced, prepared, and packaged. This in turn has a large impact on supply chains. Brands that handle this transition, will manage to bring consumers closer and come out successful. By looking at consumer conversations around the industry, brands will be able to identify the topics that will help their business as well as understand how customers are responding to inflated prices, product shortages, or delayed delivery times.

Ever since COVID-19 began, supply chains around the world have suffered, and at the moment, the strain is impacting consumer goods. From the cream cheese shortage of December 2021 to the rise in costs for various brands, consumers need to change brands, or pay higher prices for their usual products. Understanding how consumers are responding to lower product availability and higher prices will allow CPG brands to find the best ways to improve communication and prioritize production for the year.

In 2021, food prices increased globally by 28%, which made various CPG brands respond by raising the market price of certain products. Even though price indexes for products like sugar, vegetable oil, and cereals decreased in December, the predictions for 2022 are that prices will rise again. With the Omicron wave, there has been a decrease in the number of workers, and a rise in supply uncertainty, making it necessary to monitor consumers' reactions to rising prices and the low supply of products.

Identify the pandemic problem

CPG brands are being thrown a ton of challenges mostly due to COVID-19: supply chain disruptions, labor shortages, elevated consumer demand, and soaring inflation. To top it off, there’s no indication or guarantee things will start to look up in 2022. Food and beverage leaders will continue to fight to remain competitive and respond to constantly changing trends.

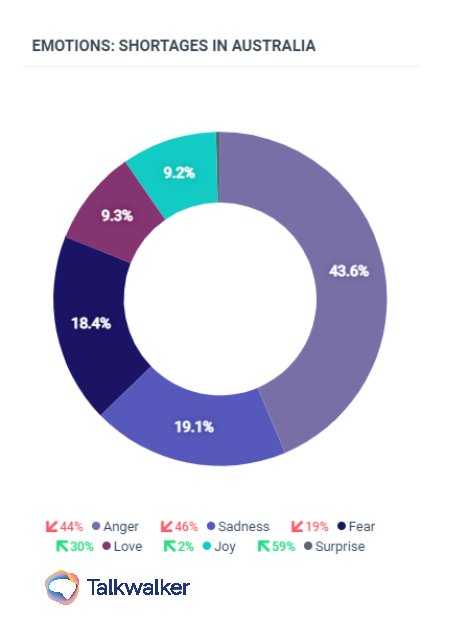

The pandemic has also caused other issues. In Australia, there have recently been shortages, which have been caused by the supply side. Omicron has generated a shortage of staff, and a third of the country's truck drivers are currently not working. Meat production has also fallen drastically, especially as the country faced shortages of rapid antigen tests. All these results have led to a total of 122K mentions of shortages in Australia during January, with a 50.3% negative sentiment. As shown below, over half of mentions have included anger, while almost 40% had a hint of sadness or fear.

Emotions surrounding shortages in Australia.

Changing behaviors and attitudes are caused by a multitude of factors, and with COVID-19, the number of consumers jumping ship has skyrocketed. A study done on agile procurement insights by SAP and Oxford Economics revealed that “70% of consumers switched brands due to supply chain problems, and 29% of them never switched back.”

Change in behavior and action remains a huge issue today, with a recent example being the supply-chain headache contributing to avocado inflation.

The prices for avocados has been driven up by inflation and supply chain delays.

CPG companies have been challenged with more empowered consumers leading to more demands while contending with new competitors. It’s the age of the consumer, and pandemic or not, brands have to try their best to keep up with erratic consumer trends and preferences. This, paired with trying to contain costs and grow revenue has made the reality of supply chain issues even more difficult.

Nearly a third of respondents cited a lack of funding for new technologies. That’s not a surprise. But funding wasn’t the biggest challenge. Other barriers included the following:

- Digital transformation of procurement function not viewed as an organizational priority

- Lack of specialized talent to carry out digital transformation initiatives

- Low adoption of new procurement processes and technologies in the organization

- Low adoption of new processes and technologies within the procurement function

CPG companies that struggle with technology adoption are not realizing the best value from their investments. There may be a tendency to revert to manual processes, which is a result of less than optimal technology adoption.

Disruption can wreak havoc on a CPG company’s already fragile supply chains. Brands that want to avoid sinking need to prepare for possible disruption and avoid delays and shortages as much as possible to meet consumer demands. What is the best way to go about navigating these tricky waters?

Solution

It’s abundantly clear that consumer brands need visible, agile supply chains. A new approach to procurement may help, as many brands are struggling to resolve procurement-related issues. To help calm the storm, there are several options CPG brands may consider to overcome the supply chain headache. Here are a few strategies to ameliorate your performance:

1. Develop digital strategies

Ensure accurate, up-to-date information for procurement and the ability to get supplies when needed. Commit to data-driven decisions and incorporate digital solutions that simplify procurement operations.

Employing digital procurement and supply chain solutions can help CPG companies streamline their processes. Faster operations and better productivity result in greater customer value and minimized costs and risks. Those benefits are worth the initial costs or hassle because improving the procurement cycle will help CPG companies triumph over the supply chain obstacles in 2022.

2. Leverage social listening and consumer intelligence

Brands need to understand their consumers, what draws them in and what might be the reason they’re switching brands. Master brand management by listening to what consumers are saying about you. Use insights and tools that will allow you to understand what is happening within the industry on social media and other digital spaces.

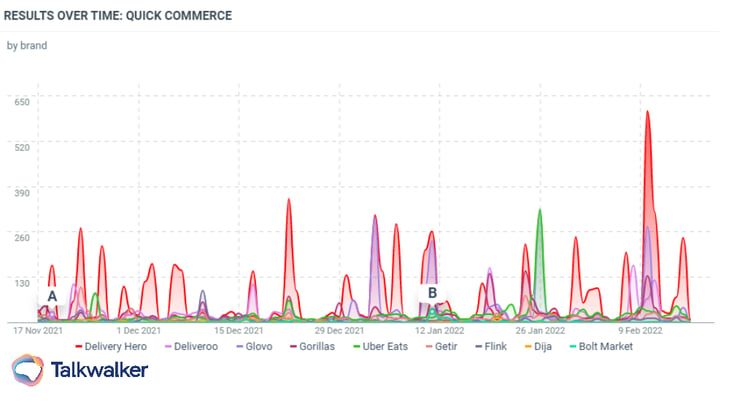

Example: As a CPG brand looking to target consumers on food delivery apps, knowing that Deliveroo is no longer in the Spanish market makes it necessary to consider another well-positioned brand like Glovo or Uber Eats instead. Another aspect to consider is how consumers feel about these apps, as shown below. The success of these companies ultimately connects to the success of your quick commerce sales channel.

Results over time for food delivery applications.

CPG companies need to invest in technologies that use data to deliver an advantage. Artificial intelligence, consumer analytics, and insights will result in simplified processes that enhance decision-making speed and agility. Consumer intelligence is the key to survival.

3. Tune into diversification and creativity

To thrive, consumer packaged goods companies need to rely more heavily on insights and harness the power of AI as well. Diversifying product lines and getting creative with strategies and campaigns is necessary to maintain engagement, keep customers, and repair broken process points.

Example: Beverage brands have been exploring the market of alcoholic drinks since the explosion of White Claw in 2016. However, the diversification in the beverage product line has also included experimentation with other products such as CBD-infused drinks and ready-to-drink cocktails. At the beginning of the year, Coca-Cola announced the launch of a new line of Fresca mixes, inspired by consumer recipes from around the globe.

Overall, the changing behaviors and shifting attitudes are causing many companies across all industries to rethink their supply chain strategy and sourcing tactics. Brands need alternate sources of supply to meet demand faster or plan ahead by keeping certain popular products stocked ahead of time. Agility and end-to-end visibility remain key components of any good strategy within the CPG industry.

Looking forward

Although 2022 has no promises of being easier to handle, brands within the CPG industry will come out ahead of competitors if they prepare, strive to understand consumers, and trust in digital strategies to improve procurement and other steps of their supply chain. Although digital procurement is not yet seen as a priority by organizations, it is a way to not only get ahead but avoid crises and survive the current global situation. Utilize social listening to tap into what consumers are saying online, and why they may consider buying a different brand. Getting creative is also another way to combat the rising demand for innovation and variety within food and beverage lines.

There’s no overnight quick-fix to solving supply chain pain points, but a collective strategy spearheaded by consumer intelligence and the application of some digital tools is sure to lessen the load.

-3.jpg?width=700&height=200&name=CTA%20(1)-3.jpg)