See what MENA media audiences are talking about

The Middle East and North Africa region is witnessing significant growth in digital media consumption, especially as users benefit from an increasingly personalized online experience that caters to their specific needs and interests. As more of the region’s population becomes connected to the Internet with 5G, there’s a surge in demand for all things related to online gaming, Over The Top (OTT) video, and social media.

Based on GSMA’s recent study, the MENA region has 44% mobile social media penetration, double the number from 5 years ago. Out of the 256M inhabitants in the MENA region, over 188M of them are active Internet users and are all looking to consume, purchase, or create digital content. Consumers have more tools and platforms to express their individuality to a community of followers who are not only shaping the conversation, but also driving it forward.

Media and Entertainment has its moment in the sun

Biggest trends in the MENA media and entertainment scene

Since Saudi Arabia opened up its cinema market back in 2018, there has been considerable demand for all things entertainment and tourism related. More particularly, the kingdom has invested heavily in attracting tourists from all over the world to come and enjoy its wide array of entertainment avenues, whether it’s concerts, international football matches, or art exhibitions. Under the umbrella of Saudi Vision 2030, the kingdom aims to become a hub for cultural production and a center for cross-border entertainment.

On the other side of the coin, regular TV is losing position to new pay-TV and players. Several countries in the MENA region are upgrading their broadband infrastructure to cater for the increasing demand for OTT services. For example, many global and local platforms are offering MENA audiences subscription-based video-on-demand services like Starz Play, Icflix, Shahid, OSN (offering Disney+ content), Istikana, Cinemoz, and many others.

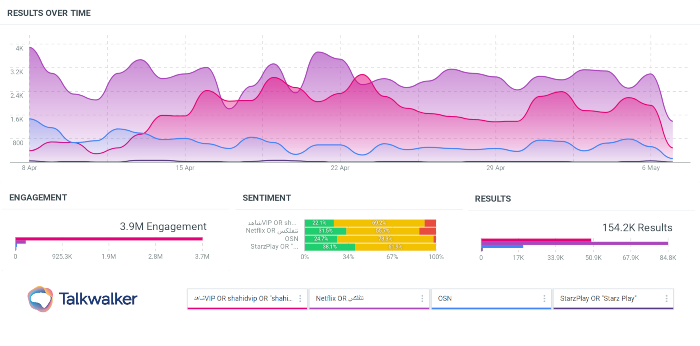

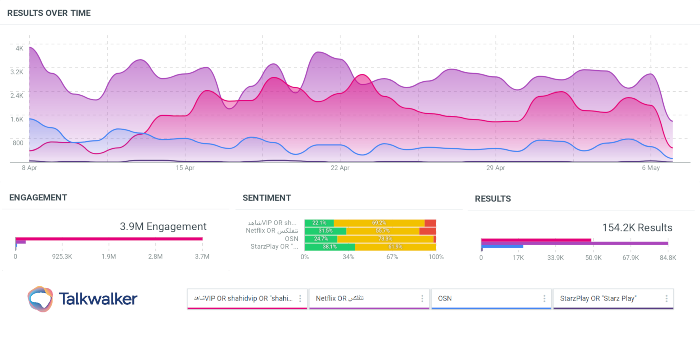

Number of mentions for each of “شاهدVIP”, “Netflix”, “OSN”, and “StarzPlay” during the past 30 days in the MENA region.

The lockdown in many MENA countries meant that media and entertainment had to prioritize the digital space. One key example is how film distributors leveraged transactional video-on-demand (TVOD) in order to address the difficulty of physically releasing new films in theatres. Similarly, the consumption of music, videos (TikToks included), and games became the primary source of comfort for millions in the region. Most recently, MBC Media Solutions reported that users are spending over 8h30 daily watching Shahid content during Ramadan.

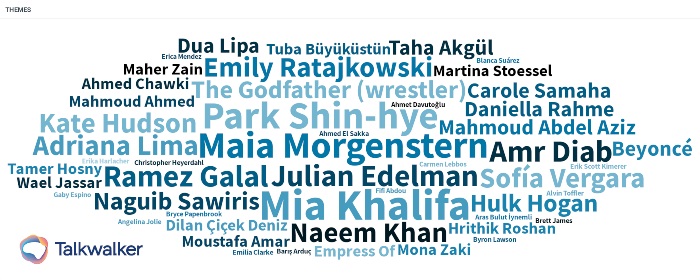

Celebrity cloud surrounding ‘مسلسلات رمضان’ during the past 30 days in MENA.

With the MENA media and entertainment market becoming more competitive than ever, companies must adopt data-driven innovation and embrace conversational intelligence as a tool to constantly create content that is impactful and relevant. Read Talkwalker’s latest industry report on the conversations surrounding the media and entertainment industry during COVID-19.